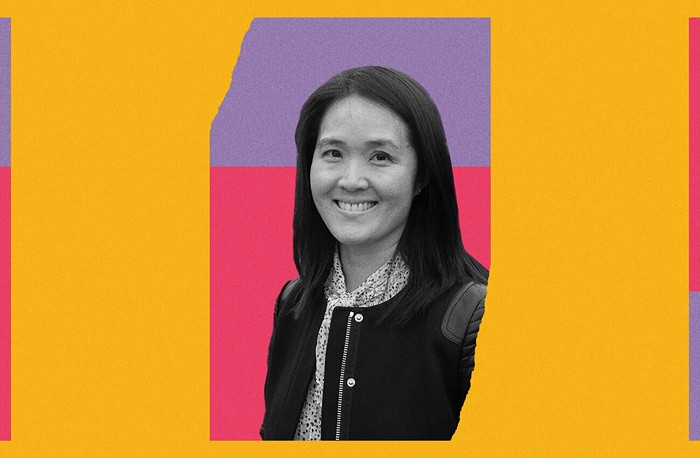

Rep. Rueven Carlyle has a theory about why the Republican-controlled Senate and Democrat-controlled House of Representatives continue to fail at finding a budget both can agree on: State Republicans are addicted to marijuana.

Carlyle, chair of the House finance committee, says the Senate's budget is over-reliant on cannabis tax revenue to cover state obligations like education—a strategy he argues is both irresponsible (since we don't know how many pot dollars the state is going to earn in a new and volatile market), and a way to avoid more meaningful, long-term tax reform.

"The Senate budget is predicated on marijuana from top to bottom," Carlyle says. "That's a precarious and fiscally irresponsible approach... those dollars allow them to avoid the more responsible approach to tax policy—and discuss things like capital gains, closing tax breaks, and other important steps."

In a detailed blog post published last week, Carlyle outlined the dangers of Republican dependence on yet-uncollected marijuana taxes to fix the state's budget problems:

Washington forecasters are anticipating our 7 million residents will consume a total of 6.2 million ounces per year. Colorado forecasters are anticipating that their 5 million residents will consume 1.4 million ounces in that same year. As I understand it, both state forecasters used the same core data and operating assumptions, metrics and customized studies provided by the respected Rand Corporation.

Here’s the difference: Colorado legislators conservatively slashed the projections in half, delayed recognizing any revenue on their books for a year, and even then revised their estimates down substantially after actual revenue collections came in at less than 40% of projections in order to avoid the uncertainty. Legislators rejected the initial estimates as too large. Our Senate is pushing to do the opposite with the same basic data: Recognize and book every penny of the initial estimates without questioning the common sense of it all...

I find it ironic that on the issue of marijuana taxation it is Democrats—who generally supported I-502—who are more cautious and fiscally conservative and Republicans—who generally opposed I-502—who are acting more like big spending addicts.

In short, he argues that the market is too new and too volatile on its own (not to mention that it's being tinkered with and that that Oregon is about to open its low-tax recreational market) to trust rosy forecasts.

"Maybe I'm being too fiscally conservative and they [Senate Republicans] are right," Carlyle says, "but it seems odd to me to meet your fiduciary, legal, and constitutional obligations to fund education based on $1.12 billion dollars of untested revenue."

Back in April, the ACLU condemned legislators' proposal to "raid" pot taxes for K-12 education—while underfunding the drug treatment and prevention provisions that were part of Washington's legalization law—as "dangerously shortsighted and unwise."

Carlyle says he is trying to rationalize the state's marijuana tax system with House Bill 2136, which would streamline state taxes to 30 percent at the time of sale instead of the current system that taxes pot repeatedly as it moves from grower to processor to retailer. The Senate is proposing a 37 percent tax—an untenable rate, Carlyle says, since Oregon's pot tax will be "a mere 10 percent," and will compete rigorously with Washington's marijuana marketplace.

Beyond the details, Carlyle adds, there are "deeper moral and philosophical questions about having just one more sin tax and pretending that that is a replacement for capital gains, closing loopholes, and having a rational tax system."

Washington State still has the country's most regressive tax system—and sales taxes are regressive taxes.

The office of Sen. Adam Hill, the Republicans' senate budget writer, did not respond to requests for comment.