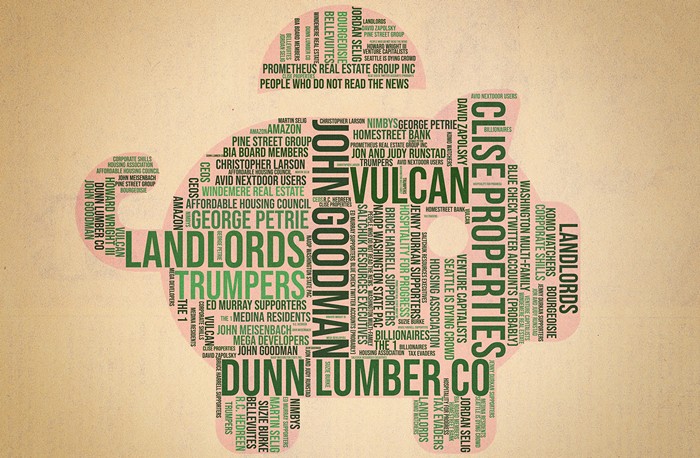

PubliCola's Josh Feit has been digging into how city council member Kshama Sawant has already spent almost all of the $51,000 she's raised for her campaign, and he's found some interesting pay practices. So far, a big chunk of Sawant's money has gone to five different campaign consultants. Today, Josh reports that the campaign doesn't appear to be paying payroll taxes, like unemployment insurance or social security, for those consultants, instead employing them as independent contractors.

As Josh points out: "Saving money by paying workers as contractors is a classic campaign tactic; former mayor Greg Nickels was caught doing it back in 2001. (Nationally, Tea Partier Sharron Angle got caught doing it in her 2010 run against Democratic leader U.S. senator Harry Reid.)" Here's more about Nickels's run-in with this issue.

It's also a practice businesses are known to use in an effort to, as the New York Times points out, "circumvent minimum wage, overtime and antidiscrimination laws," and it has come up in the debate over Uber's treatment of its drivers.

Since PubliCola's original post, Sawant's campaign manager and one of the consultants, Philip Locker, who originally said all this must have been a "glitch," has clarified that the state records are right—the five consultants were working as contractors—but that soon three of them will become campaign staffers and the campaign will be required to pay payroll taxes on their salaries. The other two (Locker and Jonathan Rosenblum) will stay on as contractors.

But, according to PubliCola, those two working as contractors don't have city business licenses, which may be required to do consulting work.

I talked to Locker about all this today, and he framed Sawant's payment methods as "common practice" and the "overwhelming practice" in political campaigns—not a line you hear from the anti-politics-as-usual camp very often. He says consultants worked as contractors early in the campaign because they were hired to "deliver certain products" like a fundraising strategy or a door-knocking plan rather than for continual, consistent work. As the campaign grows and gets closer to the election, he says more of its employees will be on staff getting paid a salary or hourly wage (yes, it'll be $15, he says).

He confirms that he doesn't have a business license but says he's gotten conflicting advice on whether he needs one or not. He's asked the campaign's lawyer and says he'll get one if he's advised he needs it. (I'm checking into this, too.) UPDATE: Cyndi Wilder, a spokesperson for the city's Department of Finance and Administrative Services, says "anyone working for himself/herself or as an independent contractor engaging in business activity in Seattle is required to obtain a Seattle business license" and that includes consulting services.

But what about the bigger philosophical question here? Hiring workers as contractors to avoid taxes and rules is classic shitty big business practice, exactly the kind of thing Sawant would usually rail against.

"We are absolutely against that," Locker says about big businesses using contractor status to avoid proper labor practices. But, he adds, "there are some positions [and] some times when it is appropriate for someone to be an independent contractor."

He believes this is one of those times.