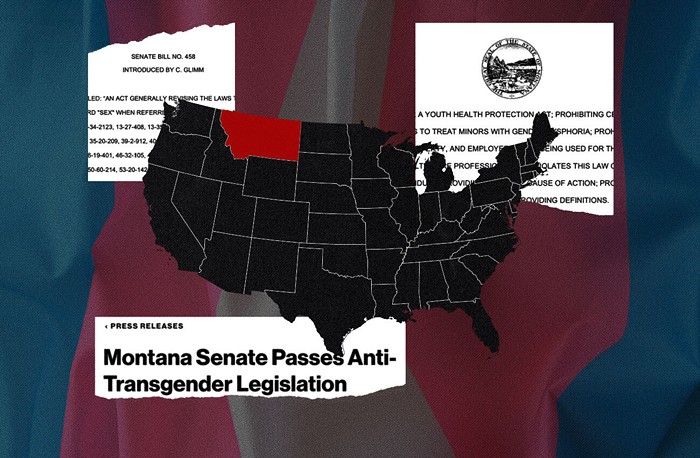

When the Seattle City Council gets back from its winter holiday, the council's finance committee will consider a piece of legislation that would take a step towards moving $3 billion of the city's holdings out of Wells Fargo.

The proposed ordinance, a collaboration between indigenous activists like Matt Remle and Kshama Sawant's office, dovetails with a national effort from anti-Dakota Access pipeline activists to take money away from banks financing the pipeline project. Wells Fargo, one of the project's main financiers, has loaned Texas-based Energy Transfer Partners $467 million to complete the pipeline, according to a Food & Water Watch investigation.

But the proposed legislation doesn't just cover concerns over the Dakota Access pipeline. The ordinance's authors take issue with another Wells Fargo scandal, including the recent revelation from federal regulators that Wells Fargo employees enrolled 2,000,000 people in fake accounts over five years in order to hit sales targets and secure multimillion-dollar bonuses.

By amending the city's socially responsible investment policies, the new legislation would:

• Require that the city's financial contractors to provide five years of data on any unethical business practices, including settlements with regulators

• Require the city's financial contractors to provide "prompt notice of any claims, settlements, pending investigations, or reasonable likelihood of claims that it has engaged in any dishonest or unethical business practices"

• Allow the city to avoid contracting with companies that have been the subject of a settlement, enforcement action, or finding that those companies have engaged in "discriminatory, unfair, deceptive, or abusive acts or practices" in the last two years and have not corrected the problem

• Clarify that the city's social investment policy seeks contractors with "fair business practices"

But the final part of the new policy targets Wells Fargo in particular. If the measure succeeds, the City Council would request that the mayor and his director of finance of administrative services divest from Wells Fargo in 2018 by not renewing the city's contract with the bank. (Important caveat here: The City Council itself does not have the executive power to sever ties between the city and the bank.) The measure also requests that the city refrain from doing any new business with Wells Fargo for a full year once the legislation is passed.

The bill has been referred to the City Council's Affordable Housing, Neighborhoods, and Finance committee in January. If it passes out of committee, the full council will take a vote in the new year, too.