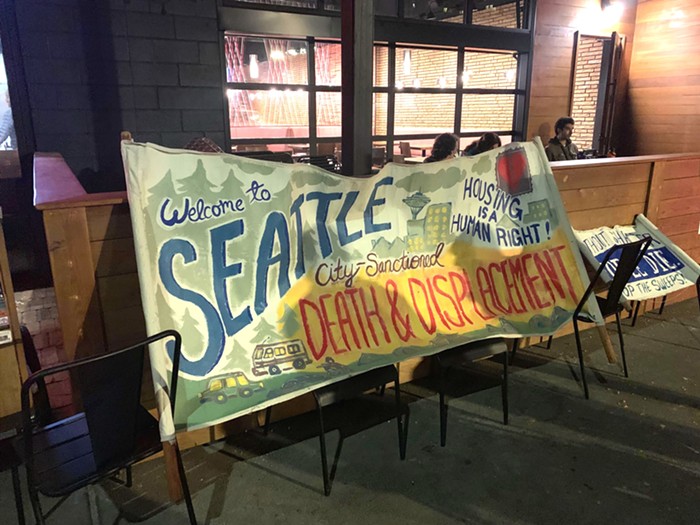

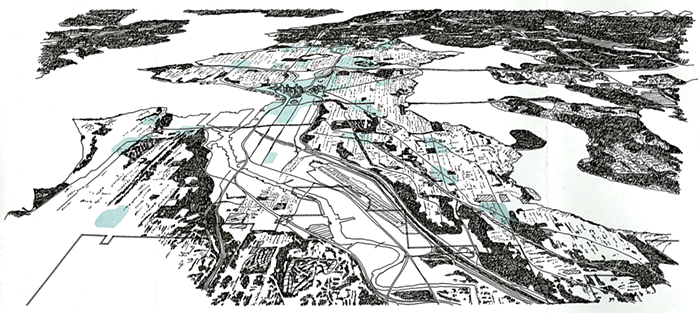

Someone is spreading misinformation that 44 out of 50 business owners in the SeaTac Market—a majority of whom are East African Muslim immigrants—are not "reporting their taxes." To support their point, "jellybeanjen," who has been described to me as a "longtime resident of SeaTac," posted a link to a homespun spreadsheet showing a list of businesses in the SeaTac market, which features a column indicating whether those businesses have reported taxes to the state. This spreadsheet allows jellybeanjen to conclude that SeaTac city council's vote to redevelop the SeaTac Market and displace all the immigrant-run businesses that have been operating there for years is not irresponsible governance, but, rather, good governance. But jellybeanjen goes further: "Because they seem to feel they are being discriminated because they are immigrant business owners, it is only right for their businesses to be investigated for paying taxes."

I do not normally fact check angry commenters who perpetuate xenophobic conspiracies about immigrants not paying their fair share, but this chart made its way to Peter Kwon, a SeaTac city council member, and Kwon told me he found it "credible." Newsflash: It is not.

The only way jellybeanjen could know if a business has "reported its taxes" is if the Department of Revenue gave her that information, or if she stole it. That's because—unless someone has filed a warrant—taxpayer information about people or businesses is not available to the public.

Anna Gill, communications director for the Department of Revenue, says the DOR doesn't share taxpayer information "past or present." After asking her staff to analyze jellybeanjen's chart, Gill says they do not recognize it and didn't generate it.

Though the DOR can't share tax information, I asked if Gill could generally compare their records with jellybeanjen's chart. "We looked into the accounts listed, and without disclosing specifics, can say that the information in the report is not consistent with what we have in our system," she said.

So, the Department of Revenue seems to believe that these businesses are reporting their taxes appropriately. But that's not enough for jellybeanjen. Like a lot of cranks, jellybeanjen has a process she used to determine whether or not these businesses have paid their taxes, and that process involves generating a list of UBI numbers from the DOR's website and then comparing them to a list kept by the Secretary of State. Here are jellybeanjen's instructions, emphasis mine:

Go to this link:

https://secure.dor.wa.gov/gteunauth

Scroll down and select "business lookup" (second from the bottom)

Under "street address" enter: 15245 INTERNATIONAL BLVD

Under "city" enter: seatac

Select "search" and you will see a list of 50 businesses at that addressNote the UBI# for one of the businesses and go to this link:

https://ccfs.sos.wa.gov/#/Home

Where it says "Search by Name or UBI:" enter one of the UBI numbers, as an example let"s use 604199617

Select "search"

You should see "No Value Found" which means this business UBI number did not report any taxesFor comparison try searching for REWA ubi number 601025856

You will see a match for "REFUGEE WOMEN"S ALLIANCE (REWA)"

Clicking on that business name will show another page with business information

At the bottom if you select "filing history" it will show all of the filing history documents

That website from the Secretary of State allows users to search for a business' registered agent, which is a person who receives legal documents on behalf of a corporation. If a business doesn't have a registered agent, then that business won't have a filing history with the SOS. The absence of a registered agent has nothing to do with whether a business has "reported taxes."

A representative from the Secretary of State confirms that not every business has to register with the them. If a business does want to incorporate in the state or register as a nonprofit, however, state law requires the business to get a registered agent to file with the SOS.

But not all businesses have to incorporate or become an LLC with the state. The most common business structure is the sole proprietorship, wherein one person or a married couple runs the business. So the fact that many of these SeaTac center businesses don't show up on the SOS's list only means that they're sole proprietors—not that they're evading taxes.

If any other SeaTac city council members, Trump-loving SeaTac mayors, or general SeaTac residents come across this spreadsheet, know that it is a meaningless and unnecessarily complicated bit of misinformation.