Charles beat me to posting about the recent whining by the credit card industry. Faced with restrictions on their recent usury, they've decided to try to ruin the credit and extract fees from customers with perfect records of responsibility.

The industry is laboring hard to claim that those who repay their balance each month (during an interest-free grace period, called "deadbeats" by these monsters for their non-fee generating ways) were subsidized by those who carried ongoing balances. Now, with the new credit card bill of rights coming online, revenues are expected to drop from the latter. Thus, fees are needed! Absolutely needed. We must punish those freeloaders, riding on the backs of the poor and destitute. From the NYT article:

“It will be a different business,” said Edward L. Yingling, the chief executive of the American Bankers Association, which has been lobbying Congress for more lenient legislation on behalf of the nation’s biggest banks. “Those that manage their credit well will in some degree subsidize those that have credit problems.”

....

Robert Hammer, an industry consultant [water-carrying industry whore], said... “They aren’t charities. They have shareholders to report to,” he said, referring to banks and credit card companies. “Whatever is left in the model to work from, they will start to maneuver.”

Bullshit. Credit card companies have long made out like bandits on the other side of this sordid business, bullying merchants while blatantly violating anti-trust restrictions. From a review on merchant fees charged by credit card issuers (PDF):

Every time a consumer makes a purchase on a credit card, the merchant is charged a fee (typically 2%—3% of the purchase price, but sometimes as high as 15%) by the credit card network. The level of fee relates to the merchant’s industry and size and, most crucially, the level of rewards (cashback or frequent flier miles, etc.) that come with the consumer’s credit card. As a result, credit card transactions cost merchants, on average, about six times as much as cash transactions and twice as much as check or PIN-debit card transactions. These fees totaled over $40 billion in the United States in 2005.

This practice insures that, contrary to this whining, the credit card industry has been profiting greatly from those who pay of their balance each month, and tend to use reward cards. The credit card companies don't pay for these rewards, the merchant do. Well, what about that interest-free grace period? Who pays for that, financing the month or so of free money the card issuers are trying to eradicate? Net 30 payments. When you swipe your card at a store, the merchant doesn't get paid right away. It takes about a month for the card company to actually pay up. Eliminating the grace period allows the card issuer to double-dip.

Anti-trust, I say? Merchants are totally screwed, and forced into this relationship, by collusion between the credit card companies. From the same review:

(1) Price-Fixing: Merchant restraints constitute a variety of federal and state anti-trust violations. The restraints are contractual arrangements between credit card networks (Visa, MasterCard, American Express, Discover) and their member banks, made with the goal of artificially equalizing the price of all credit card products and the price of competing products (cash, debit, checks). Merchant restraints are a form of price-fixing.(2) Tying: Merchants who accept low cost cards from a network brand are required to accept the high cost products too, even if they wanted to reject them. This creates a form of tying—products cannot be purchased separately, but must be purchased together. Under federal antitrust law, tying is illegal if it is done by a

party with market power. The United States Court of Appeals for the Second Circuit held in 2003 that MasterCard and Visa jointly and separately exercise market power, thus establishing the legal foundation for this violation.(3) Monopolization: By fixing the price of all payment products, consumers use more of the most expensive product (credit cards) than they otherwise would. Thus, credit card market share is artificially and intentionally inflated through an exercise of market power. This is a classic form of monopolization.

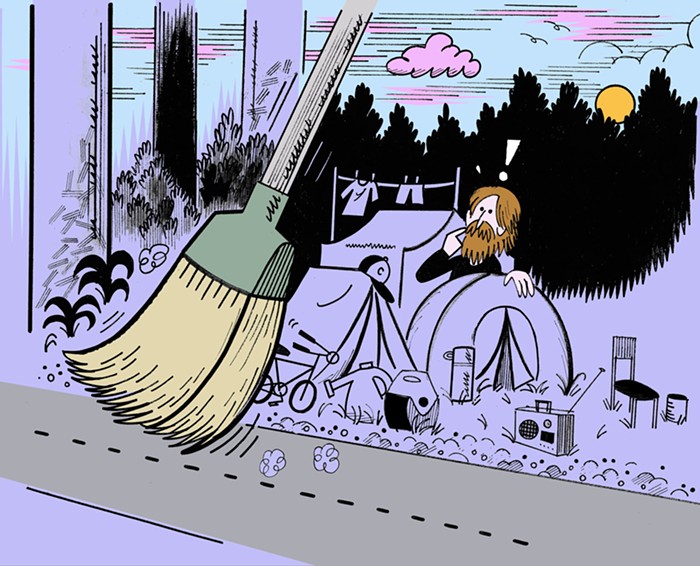

So, allow me to call you a WAAAAAAAAAAAAMMMULANCE, credit card companies. What a bunch of whiny losers.

Updated:

Commenter oldart added this point:

And, you don't even mention the most egregious ass-fucking that the banks administer to merchants: who pays the cost of credit card fraud?Answer: NOT THE BANKS or Visa/MC/AMEX. The merchant does. If a merchant takes the card, and it is fraudulent, in spite of receiving authorization at the time of sale, the merchant gets the full cost deducted from his remittance.

Yet, V/MC spend millions of dollars in advertising BRAGGING about how they protect YOU from fraud. Bullshit bullshit bullshit.

Updated 2:

From I Love IPA:

Although I agree with the rest of this post, I wanted to let you know that not all merchants wait a month for their money. Our restaurant sees those funds within 1-2 days.