- AH

- If the Metro cuts take effect, to take one example, riders of the 11 bus would lose two hours of late-night service.

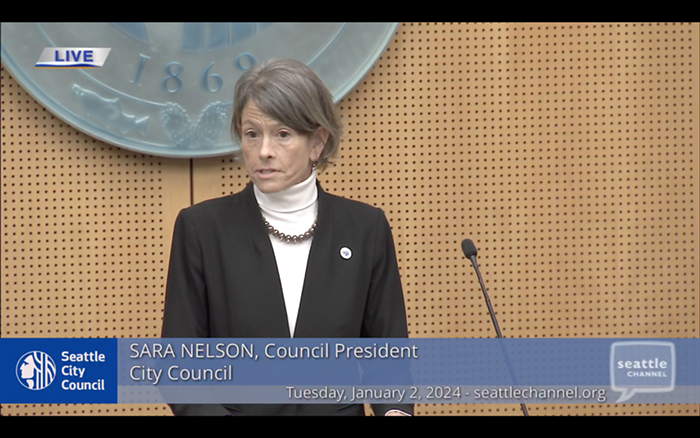

The Seattle City Council—technically the Transportation Benefit District Board, which is made up of council members ARE YOU BORED OUT OF YOUR MIND YET?—today considered two competing plans to rescue Seattle Metro service from drastic cuts. The council has just over one month, until August 5, to submit either of the plans to the county for placement on Seattle's November ballot.

If you are NOT bored out of your mind yet, congratulations! Here's where it gets interesting: the two proposals would both raise $45 million for Seattle to save roughly 300,000 hours worth of its own Metro service. But they each rely on (in conjunction with a $60 bump in the vehicle licensing fee) a different tax revenue source:

PROPOSAL A would save Metro service through a combination of a new employee head tax and a five percent increase of the commercial parking tax rate, which disproportionately affects businesses and car drivers.

PROPOSAL B would save Metro service through a 0.1 percent increase in the sales tax, which would hit Seattle's poor and wealthy equally hard, in a state that already has the most regressive tax structure in the country.

Now ask yourself: Which plan is more progressive?

Then take a guess: Which plan is backed by Mayor Ed Murray and what appears to be a majority of the City Council?

If you said Plan A is more progressive, you're right! And if you guessed that Plan B is the one backed by the mayor and an apparent council majority, you're also right.

Only Council Members Licata and Sawant are backing Plan A, so far. Why aren't other members with them? Well, we do know that being with Licata and Sawant means going up against the Seattle Metropolitan Chamber of Commerce. The chamber's senior vice president, George Allen, all but threatened the council this morning during the public comment period: "Today we're lucky to have cranes over our city," he said, "but [businesses are] looking at that [proposal from Sawant and Licata] as another reason for businesses to look elsewhere." He accused them of "muddying up the discussion on transit needs" and pledged the chamber's support for the Murray-backed plan. Emphasizing his opposition to the employee head tax, he concluded: "Do not tax jobs, the very thing we're trying to create."

Before Licata introduced his joint proposal with Sawant, the council used its time to ask detailed questions of Murray's staffers about his preferred plan. At that point, Transportation Committee Chair Tom Rasmussen apparently felt the need to give voice to the some of the most powerful interests in the city. He said University of Washington and the Virginia Mason hospital conglomerate had objected to increases in the commercial parking tax before. "UW was concerned that its U-Pass program would be severely affected," Rasmussen said.

That prompted a harsh rejoinder from Sawant: "This comes down to a political battle: whether the council is interested in pushing back against that sort of bullying...and saying no, UW is totally capable of weathering that sort of impact." She cited the $768,500 salary for President Michael K. Young and the university's recent renovations to its football arena as evidence that they can absorb a higher tax burden.

Furthermore, Licata explained, the sales tax cannot be depended upon to fund Metro. Here's how he and Sawant summarized that argument in the Puget Sound Business Journal:

Our approach provides greater funding stability by avoiding additional reliance on sales tax. Sales tax has proven to be an unstable revenue source for the city and other local governments because recessions have a direct impact on jobs and spending ability. The dot-com crash in 2001 reduced sales tax revenue and forced Metro to scale back plans to increase service, and in 2009 Metro lost more than 15 percent of its sales tax base due to the recession.

Seattle is restricted by state law in tons of distressing ways, including the ability to freely levy progressive taxes (the city doesn't have, for example, MVET taxing authority, which would be the simplest way to fund transit). But Licata and Sawant are trying to open the window to another kind of progressive tax. "I think it's our duty to use progressive taxation in the limited way it's available to us," Sawant said. "As far as concerns this will affect the business community, I would say the money has to come from somewhere. If we're going to put the burden on working families, that will not be good for the economy."

This is why it is so goddamn important, by the way, to have a voice like Sawant on the council—one that calls the business community's consistent bluff (anything progressive will kill jobs!) and reframes the debate over what's good for the economy from "what's good for business" to "what's good for workers."

So: Are we, as a city, going to raise taxes (there's also a 25 cent fare increase coming down the pike next March) on the most vulnerable people who depend on bus service? Or do we believe businesses should pay their fair share? We have five weeks to answer that question and get something on the ballot for November. The next public hearing on this question is Thursday at 5:30 p.m. in council chambers.