Last week it was revealed that Seattle property taxpayers would "subsidize" a Sodo arena to the tune of approximately $780,000 a year , a revelation that some critics seized upon to accuse arena proponents of misleading the public about the terms of the deal. That's not entirely fair. This property tax shift could have been discerned from the Memorandum of Understanding (MOU) by any property-tax-savvy reader who bothered to try. And when no one did, it was the mayor's own budget office that volunteered the information.

But yes, contrary to the implied promise of a "self-financing arena", the proposed deal would result in a $2 to $3 bump on the property tax bill of the average Seattle homeowner (35 cents for King County homeowners outside of Seattle), and yes, the city/county portion of this extra revenue will be dedicated entirely toward servicing the arena bonds. But there will be zero hit on public coffers, and it is important to note that this extra revenue would not be possible without the arena so it couldn't be used to pay for other city services. To understand why requires a brief (if wonky) discussion of how property taxes actually work, followed by a stepping through of the unique terms of the MOU.

As I explained in Part I of this two-part series, the whole tax issue is a lot more complicated and nuanced than the initial media reports have made it out be. When we think of taxes we mostly think of sales and income taxes, wherein the government sets a rate and then revenue comes in ahead or behind of forecasts depending on the strength of the economy. Consumers buy more stuff and sales tax revenue goes up. Surpluses, yay! Consumers buy less stuff and sales tax revenue goes down. Deficits, boo! Simple.

Property taxes don't work that way. Instead, a taxing district, within certain limits, sets a dollar amount it would like to raise in any given year, and then the county assessor sets a "millage" rate (dollars per thousand dollars of property) based on the total assessed property value within the district. That's why as home values broadly plummeted in the housing bubble collapse, your property taxes didn't plummet with them. The millage rate simply climbed to make up the difference. The expiration of voter approved levies aside, your property taxes only fall if your home's value falls relative to the district as a whole.

It's also why property tax levies tend to raise exactly what they're intended to raise. Your house could burn to the ground and it usually wouldn't impact city coffers. Rates would simply rise slightly the next year to offset the lost revenue from your property. And as I'll explain later, that's kinda what's happening with the arena deal.

Of course there are restrictions on how much a taxing district can raise. Washington's constitution imposes a limit of $10.00 per thousand dollars of value (one percent) on regular levies (those levies that do not need to be approved at the polls), which is then split up between various "senior" and "junior" taxing districts. Cities like Seattle may levy a maximum of $3.60. This is known as our "statutory limit." The total regular levy the city can annually raise can at no time exceed 0.36 percent of the total assessed property value within city limits.

But in practice Seattle and other taxing districts currently fall far short of their statutory limit thanks to additional restrictions imposed by Tim Eyman's Initiative 747 (and later reimposed by the legislature after a court threw it out), which limits the annual increase in regular levy revenue to one percent above that raised the previous year, plus the revenue raised from new construction. This one percent plus new construction total then becomes the basis for the next year's I-747 calculation, and so on. Despite years of declining property value that have pushed the rate higher, Seattle's 2012 regular levy stands at only $3.12, far short of the statutory cap. But remember this "new construction" exemption to I-747's limits, because that's at the heart of this $780,000 subsidy.

So, where does this $780,000 figure come from?

According to tax rolls the assembled arena parcels are currently assessed at $34.1 million, generating about $106,000 a year for the city at Seattle's $3.12 regular levy rate. That's the amount the parcels' current owners will pay into city general fund coffers in 2012.

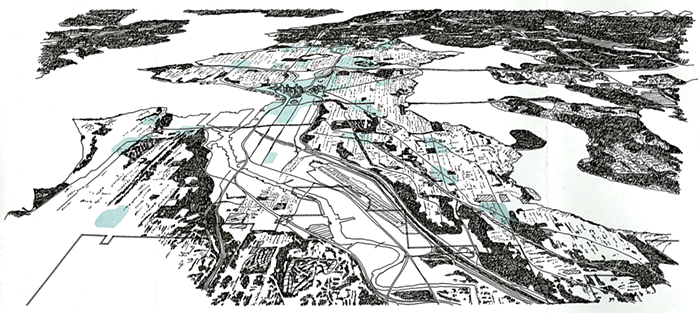

Hansen claims that acquiring the properties will cost him well in excess of $40 million, but once all the permitting and preparation and whatnot is complete, the assessed land value could rise to as much as $100 million, at which point the city/county would purchase the land (after an NBA team is acquired but before arena construction begins), removing it entirely from the property tax rolls.

However you value the land—$34.1 million, $40 million, or $100 million—the rising land value doesn't change the city's levy capacity, which is constrained by I-747's one percent annual limit on revenue growth, so removing the property from the tax rolls has no impact on city coffers. But the value of new construction does.

Now here comes the complicated part of the MOU. After the arena construction is complete, ArenaCo will retain ownership long enough for the new construction to be assessed and added to the property tax roles. This both increases the city's property tax base by another $250 million or so (the estimated value of the building itself), and it increases the basis for calculating levy capacity under I-747's restrictions by about $780,000. That's where the $780,000 figure comes from: the approximate $250 million valuation of the arena building multiplied by Seattle's current millage of $3.12 (or 0.312 percent).

In truth, by this calculation, there's actually more than a million dollars a year of taxpayer subsidy when you add in the county's regular levy, as shown in the table at the top of Part I.

Under the terms of the MOU the city/county then purchase the arena building, removing its $250 million value from the property tax rolls, but leaving its newly expanded levy capacity in place. The effect of this transaction is to leave Seattle with the capacity to raise an additional $780,000 a year in property tax revenue than it otherwise would have under I-747's restrictions (the county an additional $237,000). And under the terms of the MOU, that money will be dedicated toward servicing the arena bonds.

That is the shift—the "subsidy"—that people are talking about. But it's not the entire picture.

As was previously explained, the land the arena is built on will also be removed from the property tax rolls, but that shift should be more than offset by the taxes ArenaCo will pay on the substantial "personal business property" it will own within the arena—things like the scoreboard and other equipment—which could account for $70 to $140 million of the arena's total cost. Personal business property does not expand the city's property tax capacity under I-747, so this represents a shift from other property tax payers within the district to ArenaCo.

Likewise, a further shift will occur as property values rise within the vicinity of the arena, especially those parcels to the north on which Hansen plans to develop a larger entertainment/retail complex. Some of this will result from rising land values and some will result from new construction, which will expand tax capacity under I-747 and thus be additive to city and county coffers. Then again, rising land values in Sodo could hurt cargo operations at the seaport, decreasing tax revenues there. Who knows?

The end result is that the arena deal is not entirely "self-financing" in that non-attendees will subsidize the arena at least a little, in the form of higher property taxes. But it is once again important to note that this is not regular levy revenue that could be used for any other purpose, given that the extra taxing capacity would not exist but for the arena itself.

So there you have it: A two-part explication of the arena taxes. Wonky, sure. But something to refer back to as we engage in higher level discussions.