There was much talk after the recent terrorist actions in Brussels of a “war against Europe,” and how it was an attack on the European Union’s freedom. “The whole of Europe has been hit by the Brussels attacks,” said French president François Hollande. German interior minister Thomas de Maiziere stated that because the targets of the attacks were so close to European Union institutions, they were not “solely against Belgium” but “everyone in the EU.” These kinds of nationalistic feelings were frequently and confidently expressed.

The attacks in Brussels, the administrative capital of the European Union, were, according to this view of things, much like what attacks on Washington, DC, would be for Americans: a direct challenge to the institutions of their democracy.

But here is the difference. The EU institutions in Brussels, the ones so cherished by Germany’s interior minister, the ones seen as the true targets of terrorists with totalitarian designs, are not at all democratic. In fact, the institutions that dominate Europe today are mostly not in Brussels but in Frankfurt, the banking capital of Germany, and as a consequence, the European Union. This is the hard fact that Yanis Varoufakis had to swallow during the six months he held the position of Greece’s finance minister (January to July 2015).

Varoufakis will discuss his new book, And The Weak Suffer What They Must: Europe’s Crisis and America’s Economic Future at Town Hall on Sunday, April 24.

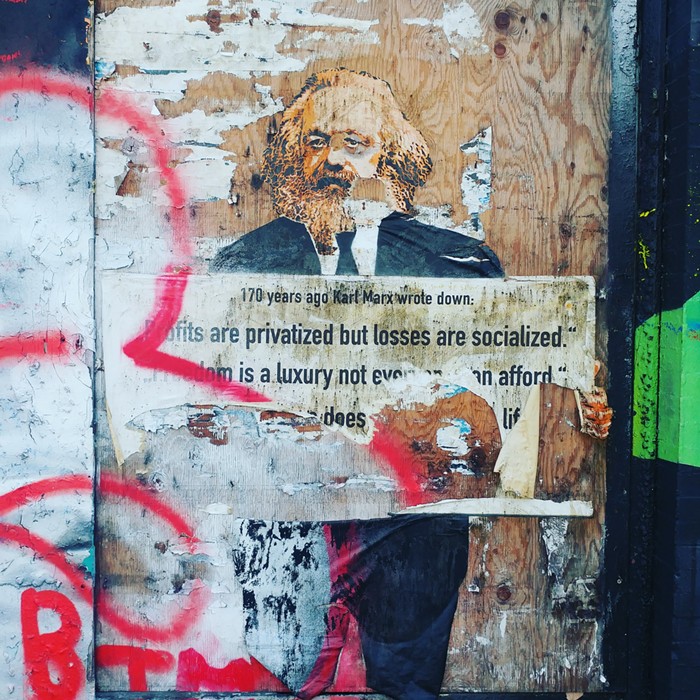

Varoufakis is an economist, and despite what many say, not a Marxist or even a radical. He is a European social democrat to the bone. The English-speaking world would call him a post-Keynesian. He and the thinking of Joan Robinson are tight. Varoufakis believes that there are obvious solutions to the European crisis that began in 2010 with Greece and then spread to Ireland, Spain, Italy, and Portugal. But these solutions, which are fundamentally rational, cannot be activated or even considered as policy because those making major economic decisions in Europe are not elected, often hold secret meetings, and automatically side with policies that favor Europe’s banking community.

Varoufakis describes and explains all of this in lively detail in his new book, And The Weak Suffer What They Must: Europe’s Crisis and America’s Economic Future. He began writing the book before he became Greece’s finance minister, but he put it aside when he was hired to serve as the living frontline of an economic collision between Greece’s anti-austerity citizens and Frankfurt banks that ordered the small Mediterranean country to fully repay its 300 billion euro debt. He began working on the book again after he was fired.

The book has one message: The Europe we have today is only a currency union, but what’s needed to address a crisis like the one that hit Greece and Portugal and Spain is a European Union that’s democratically accountable. And this accountability is not opposed to capitalism or the profit motive. Varoufakis is not on the far left. Meaning, he is not trying to realize a world after capitalism (that’s me); he is a thinker who works not with an imaginary world but rather with the world in which he lives. And his book describes that world with the eye and ear of a novelist.

The book’s narrative: These are the institutions of global capitalism, this is how they were formed, this is how they were deformed, this is why they were deformed, these are the names and faces (all white men) of those who played a role, this is why we have the European Union we have and not some other kind. And what is the central problem in Europe at this moment in history? The banks are totally running things.

Now here is the thing: The United States appears to be light-years ahead of Europe politically and economically. We have our serious problems, and there is a reason why anti–Wall Street Bernie Sanders is one of the biggest names in American politics today, but consider this: The Federal Reserve (the US central bank) still considers full employment as one of its two mandates (the other being low inflation—the value of money) when it makes its decisions. The European Central Bank does not. For the ECB, it’s all about the money. So when Varoufakis, as finance minister, argued with the representatives of Greece’s creditors about how his country could not grow economically if all it’s doing is killing jobs to pay its debts, he discovered that the they, the ECB and Frankfurt, did not care about all of that rational stuff. They just wanted their money. And the fact that he was making too many rational arguments cost him his job.

Now think about this: If the terrorists had bombed the Bundesbank in Frankfurt—instead of an airport or a train station—how would the public have responded? Would the papers and internet be filled with stories about how these evil Arabs are attacking the heart of Europeanness? Banks? Seriously, how would Europeans who have suffered from years of bank-imposed austerity, and a deep decline in democratic power, felt about an Islamic terrorist action that happened in Frankfurt, the true capital of the European Union? ![]()