A bank may seem an unlikely hero to the Occupy Wall Street movement, but then, Bank of North Dakota is an unlikely bank. Founded in 1919 in the midst of a populist uprising, Bank of North Dakota is the only state-owned bank in the nation, which many credit with insulating North Dakota's economy from the global financial crisis.

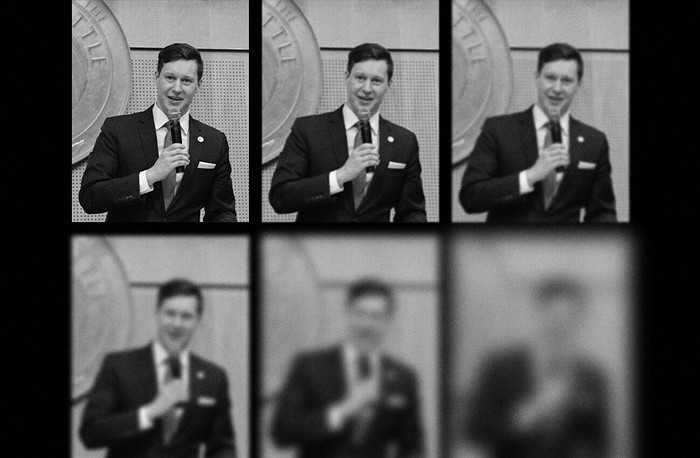

Now Washington State could copy that template if state representative Bob Hasegawa (D-11) has his way in the legislature in the next several months.

"We control our money, we make money off our money, we decide how to use it," says Hasegawa. "It's a time-proven model."

Following North Dakota's lead, our public bank would be the sole depository for all state government monies. Every penny of state tax collections and fees would make its way through the state-owned bank. That's opposed to the banks in which Washington State currently holds its money (mostly in Bank of America). That means the state could both profit from its own interest and direct its investments locally.

It's "win-win" declares Hasegawa, and given the current climate, he's hoping a politically winnable issue.

Leveraging a state cash flow of about $35 billion a year, our bank would largely function as an economic development engine, mostly by providing guarantees, subsidized interest rates, and additional liquidity to private financial institutions on loans deemed to stimulate economic development within the state. Rather than competing with local banks, our bank would work with them, like Bank of North Dakota.

But it's hardly an easy sell. Hasegawa has introduced a similar measure in Olympia twice over the past two years. He's hoping that now—when reinvesting in local economies and scolding Wall Street have become more popular political platforms—he may get more traction.

According to an analysis conducted in December 2010 by progressive think tank Center for State Innovation, a Bank of Washington could start paying dividends back to taxpayers by its third year, with profits quickly ramping up thereafter. Within a decade, the bank could return $40 million in cumulative dividends per $100 million in start-up capital, by year 20, $132 million, and by year 40, a staggering $743 million. And that's on top of the community investment the bank would help finance and the jobs that would create.

"Even some Republicans have come up to me to say that it's a good idea," says Hasegawa, though whether they'll buck their leadership is another question. ![]()