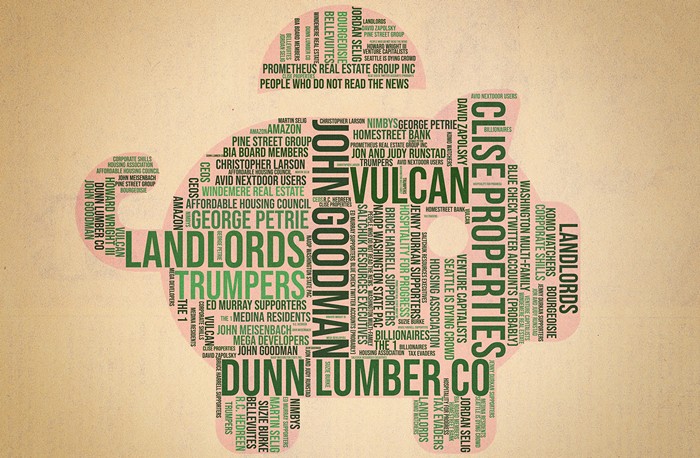

The fact is the investor class has entered Seattle's real estate market and is contributing to the current rapid inflation of property values. On this point, I agree with Seattle Times' Brier Dudley in his post "For Seattleites, homeownership is still a foundation of the American dream." As he points out, properties in Seattle are being converted into "investment products, similar to the way mortgages were commoditized before the 2008 market crash." Where I disagree with Dudley, and disagree sharply, is his solution to this growing crisis.

For him, it is a matter of the progressives siding with NIMBYs against the power of Wall Street and the global investor class. And he thinks that rezoning measures that increase density would only deregulate our property market and make it easier for the investor class to transform homeowners into renters and place homeownership out of reach of the poor. Yes, NIMBYs in this curious picture of the situation are good for poor people.

Of course, Dudley is wrong. If we stop building and submit to the NIMBYs and freeze our city in time we will end up like San Francisco, which is the most expensive city in the US (in terms of housing) and is in desperate need of more units. But is the solution just to build more and more, as those who support rezoning believe? No, it's not as simple as that. An alliance between urbanists and developers (laissez-faire economics) will only lead us to the Terminal City, Vancouver B.C., a city that is as expensive as San Francisco but for the opposite reason: the market is building a ton but building a ton for the wealthy and the global investor class. Dudley then is offering one way to hell rather than another.

A part of the problem is homeownership, which Dudley thinks is the foundation of American prosperity. But homeownership, like car ownership, is only made possible by massive government support. The plasma of American real estate is the state. The market alone doesn't have the legs to sustain long-term mortgages without federal assistance. The American homeowner and the suburbs are the product of a socialism that's acceptable to capitalists.

What happened is this: In 1930s, when the construction sector was in a deep slump, and no end of the slump was in sight, there were two ways to revive it and get people working again: build government housing for the poor or set up a financial structure that would stimulate growth by protecting banks from bad loans and offering low-interest long-term loans to those who were outside of the housing market. The market encouraged the latter solution and did everything in its power to destroy the former one (which competed directly with the interests of investors and land speculators). To this day, no one, and certainly not our dear Mr. Dudley, would dare to take the first option seriously. Such was not the case for many Americans in the year that gave the developers and bankers the backdoor socialism of the 30-year mortgage.

The Economist:

America’s housing system has always been unusual. In most countries banks minimise their risk by offering short-term or floating-rate mortgages. American borrowers get a better deal: cheap 30-year fixed-rate mortgages that can be repaid early free. These generous terms are made possible by the support of a housing-finance machine that funnels cheap credit to homeowners and, in doing so, takes on the risk, thereby shielding both the borrowers and the investors.

As for homeownership, there is very little in it that is actually good for most Americans. First, 50 percent of Americans have no wealth to speak of. And the only realistic way to own one of these state-supported homes is by raising wages. But wages have been stagnant for the middle class and falling steeply for the working poor since the 1970s.

"Five Decades Of Middle Class Wages"

UShttps://t.co/6aQNPX4DFv pic.twitter.com/fGChypqaH2

— IDEAeconomics (@IDEAeconomics) August 22, 2016

And for those fortunate to own home, they have become dependent on the inflation of property values to make ends meet. This has made them fearful of anything that might cause the stagnation of or decline in home values. And once the history of American racism is in this mix, and you end up with contradictions like very white neighborhoods voting for a black president or a Jewish American socialist.

A solution? I recommend reading the fourth part of a series, "Seattle's Housing Crisis," assembled by Cary Moon and myself.