The New York Times piece by David Leonhardt, "The Rich Really Do Pay Lower Taxes Than You," claims that "for the first time on record, the 400 wealthiest Americans last year paid a lower total tax rate — spanning federal, state and local taxes — than any other income group..." The middle class, which has experienced very slow to no growth in wages, has not benefited much from this striking state of affairs. As for the working classes, they have seen money wages (what they earn, say $7 an hour) remain flat while their real wages (what that $7 an hour can buy) sharply decline.

Leonhardt correctly points out that low tax rates on the rich "actually harm[s the] American economy," but he fails to provide the needed link between taxes, which are collected by the government, and the economy, which is governed by the market. A proper explanation of this link is of vital importance because few in the public know what money actually is and what it does in a market-directed economy. The common opinion is that taxes fund the government, which, for many, has a dubious redistributive function. Even on the left, taxes are often described in purely moralistic terms. The government must punish those who have plenty so that it can reward those who are not fortunate. In this respect, taxes can be reduced to a matter of envy.

But the essential reason why it is necessary to heavily tax the rich is not so that the government can pay for social programs. The function of taxes is purely capitalistic. Taxes spoil money in much the same way that time spoils cheese or a loaf bread.

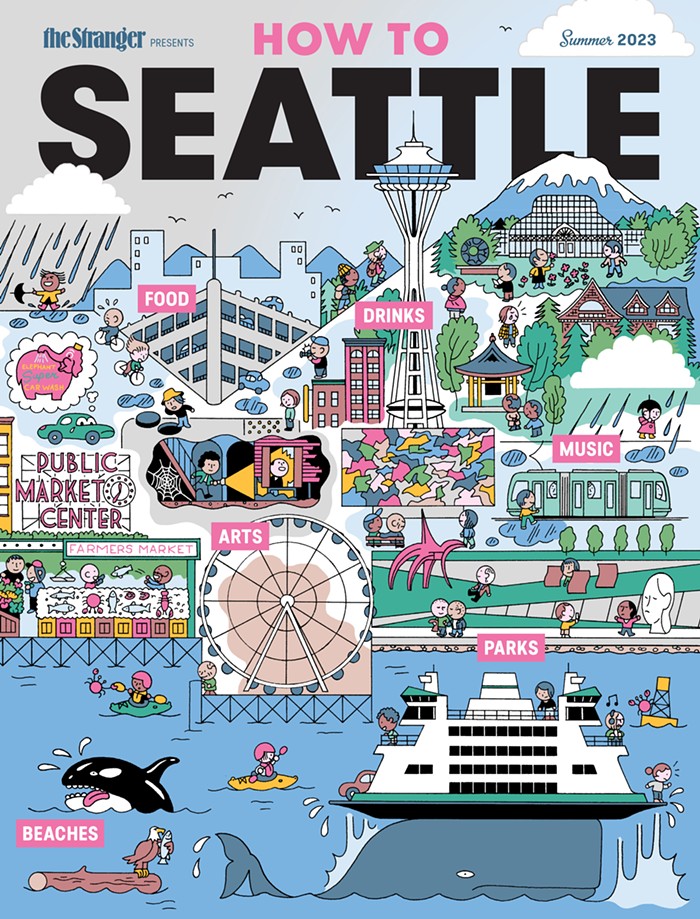

Watch how radically taxes on the wealthy have fallen over the past 70 years:

(Full column: https://t.co/XP0a4Iljti) pic.twitter.com/dGxmOjQ1b5

— David Leonhardt (@DLeonhardt) October 7, 2019

At this point, I must inform the reader that I'm eco-socialist (free energy, no-growth), and so what is presented below is not my opinon on the matter, but is instead an effort to make clear what capitalism is and what its limits and strengths are.

Now, for a deeper understanding of the function of money in a capitalist system, one needs to read the 17th chapter of John Maynard Keynes 1936 book, The General Theory of Employment, Interest and Money. In that chapter, titled "The Essential Properties of Interest and Money," it's stated that, one, interest on money is "nothing more than the percentage excess of a sum of money contracted for forward delivery" (or, put more straightforwardly, that borrowed money will be returned in the future with more money added), and, two, that other capital-assets (something that can be bought or sold on the market) also have this property. You can have some form of interest set on bread or milk. But what makes money peculiar from other capital assets is that it has exceptionally low carry costs, and the consequence of this is that its "liquidity-premium" is very high. A banana, for example, has very high carrying costs. You need to store it, transport it, and sell it before it goes bad. These costs quickly diminish its value as a capital-asset. Not so with money.

John Maynard Keynes writes:

Different commodities may, indeed, have differing degrees of liquidity-premium amongst themselves, and money may incur some degree of carrying costs, e.g. for safe custody. But it is an essential difference between money and all (or most) other assets that in the case of money its liquidity-premium much exceeds its carrying cost, whereas in the case of other assets their carrying cost much exceeds their liquidity-premium.

An excellent example of one of the few carrying costs of money can be found in the report of a ATM machine that was stolen from a general store, Big Wally's, in a sleepy town that's between Washington's biggest cities, Seattle and Spokane, Coulee City. This is what happened: A man and woman used a cutting torch to break into the general store and unplugged the ATM, which stood next to a F'real fridge stocked with milkshakes, smoothies, and frozen cappuccinos. The machine was also beneath a mural of a monstrous fish (buggy eyes, razor-sharp teeth, muck-green scales, a fin like flames). The man and woman dragged the machine out of the store, loaded it into their SUV, and split. It is not hard to imagine what happened to this ATM after the theft, its body (wires, circuits, and chips) was eviscerated by an axe until it exposure its belly of cash. Indeed, “split the lark and you'll find the music." And what you will also find is one of the carrying costs of money: the need of safe custody.

We're seeking the two burglars who stole the ATM from within Big Wally’s in Coulee City early this morning. The male and female used a cutting torch to break into the store then loaded the ATM into this white SUV. Call 509-762-1160. pic.twitter.com/6BRq1VIShE

— Grant County Sheriff (@GrantCoSheriff) October 7, 2019

Because the liquidity-premium of money is much higher than its carrying costs, it's an ideal medium for connecting the present to the future. The value it has now can be expected to remain a year from now. A egg, which is a commodity, just can't do this. But this peculiar property of money, as Keynes calls it, throws all sorts of difficulties and contradictions into the proper functioning of a capitalist system.

Recall Marx's words about how a miser "is merely a capitalist gone mad" because the way capital expands in a market economy is "by constantly throwing it afresh into circulation." Here, Marx was wrong, and Keynes saw the matter in a much better light. The business of throwing cash into circulation may have vividly been there at the early stages of capitalist accumulation, but soon, the future-value of money began to dominate. What Keynes understood is that it's not easy to induce capitalists to make big investments (building plants, producing goods, employing workers). They would much rather hold onto cash (liquidity preference) because cash has a much better connection with the future than, say, a factory or a restaurant. The consequence of the dominant propensity to hoard is that it removes capital from circulation, and this gums up the market's machinery. The idea that giving the rich money in the form of tax cuts because they will make investments is pure madness. The rich do not want to be entrepreneurs. Their goal is to accumulate wealth by-way-of rents (value increases on financial assets like property or bonds).

How can we prevent hoarding, and the resulting capital scarcity? By, of course, doing what carrying costs do to a banana. Meaning, by making money rot if it is stocked or stored for a long period of time. One way to make this happen is through deep, negative interest rates. Another, which Keynes mentions in the penultimate chapter of his book, is to put a time stamp on money—meaning, you need to use it or reissue it before the date on the dollar. Both these solutions, however, have the same flaw, which Keynes describes in this way:

The idea behind stamped money is sound. It is, indeed, possible that means might be found to apply it in practice on a modest scale. But there are many difficulties which Gesell did not face. In particular, he was unaware that money was not unique in having a liquidity-premium attached to it, but differed only in degree from many other articles, deriving its importance from having a greater liquidity-premium than any other article. Thus if currency notes were to be deprived of their liquidity-premium by the stamping system, a long series of substitutes would step into their shoes—bank-money, debts at call, foreign money, jewelery and the precious metals generally, and so forth.

Exactly. Taxes, however, are as fluid as the medium of money (change it, and we can tax that change), and can also make money rotten. This is why the rich hate taxes so much. It's not that money is taken away from them, but that high taxes turn money, to use Keynes' expression, into "green cheese." At that point, you can finally force, by state authority, the rich to become Marx's sane capitalists, or you can fund, in Mariana Mazzucato's sense, state entrepreneurialism. As Keynes wrote: "The important thing for government is not to do things which individuals are doing already, and to do them a little better or a little worse; but to do those things which at present are not done at all."

Combine state intervention with taxes and the rich must throw cash into actual investments, into circulation, to keep them rich. This is not trickle down economics; its deluge economics. And this flood would eliminate the scarcity of capital.