Earlier this year an investigation from Washington's Insurance Commissioner's office revealed that a company called Aliera was running a scam. Last week, the commissioner banned the company and its shell, Trinity HealthShare, from operating, and told the them to pay $150,000 for potentially tricking thousands of Washingtonians into believing they had health insurance when they really only had a medical cost-sharing agreement from a company that legally should not exist in the first place.

If you were looking at the shockingly "affordable comprehensive healthcare choices" Aliera Healthcare Inc. was offering through Trinity back in 2018, you'd be forgiven for thinking they were selling you health insurance.

Their plans—which ran between $91 and $260 a month—come in "bronze, silver, and gold," just as they do on the Obamacare exchanges. They offered year-round enrollment and "a wide range of comprehensive healthcare solutions," according to some random promotional materials I found on Instagram.

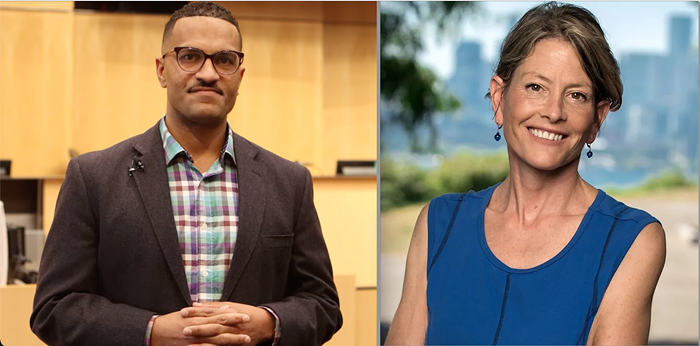

They trotted out Chase Moses, executive vice president of Aliera, to pitch the company's "solutions," which they achieved through "innovation." Get a load of this alleged scammer and his fashy haircut:

In this "interview" with the Balancing Act, Moses says Aliera's comprehensive plan is "40 percent less than most traditional plans, [so] you're still saving a lot of money, but getting what you're used to."

Sounds great! Until you get sick, file a claim for basic benefits required in all real insurance plans, and then get rejected.

That's the story of Washington resident Roslyn Jackson. According to a lawsuit seeking class-action status against Aliera and Trinity, Jackson says her monthly arthritis treatments were "denied in full" by Aliera. Another Washington resident, Dean Mellom, says Aliera rejected his claims for "various health procedures, including surgery" as a result of a 24-month waiting period imposed on some of those procedures. A real insurance plan would have covered those arthritis treatments and could not have imposed a waiting period.

Both Jackson and Mellom say they received cards stating that Aliera was a "'Health Care Sharing Ministry recognized pursuant" to a federal statute, so they thought everything was all good.

The only problem with the wording on those cards, however, is that Aliera is not "recognized" by the government as a Health Care Sharing Ministry, which is a kind of religious cost-sharing group where good Christians can share health care costs so long as they're being good Christians. (More on this later.)

In fact, according to the investigation from Washington's insurance commissioner, Aliera is the marketing arm of Trinity, a company Aliera incorporated in 2018 to serve as a nonprofit shell through which it could funnel premium payments for profit. Over 80 percent of the premiums paid to Trinity were passed to Aliera and its owners as administrative fees, the lawsuit alleges.

Washington's investigation further found that Aliera used deceptive marketing practices, such as the weird interview posted above, to lure in customers and to sell them junky "health care sharing" agreements as if they were insurance.

The commissioner claims Aliera/Trinity sold "3,058 policies to Washington consumers and collected $3.8 million in premiums." Kaiser Health News reported on several complaints from local policyholders who thought they were paying for real insurance when they weren't, and only found out when Aliera refused to cover their hip transplant, their cancer treatment, or their emergency care.

But Aliera doesn't only operate in Washington. The company has "100,000 members nationwide and reported revenue of $180 million in 2018," Kaiser reports. That's potentially thousands of horror stories of people slapped with massive medical bills for stuff that would have been covered under an actual insurance plan.

In a statement, Aliera said it "never misled consumer and sales agents" about its health plans, and added that their "website, marketing materials and other communications clearly state that Trinity health sharing products are not insurance."

While it's true that Trinity's website now explicitly states, in all caps, that its health sharing plans are "NOT INSURANCE," that was not the case in January of 2019, before the company started catching all this heat. Back then, those all-caps disclaimers didn't exist. Website copy advertised Trinity as an "alternative solution to the rising costs of health insurance without sacrificing on great healthcare."

And the other problem, as I mentioned earlier, is that neither Aliera nor Trinity appear to be legitimate Health Care Sharing Ministries (HCSMs) in the first place. Federal law, which Washington state law mirrors, only recognizes HCSMs created before Dec. 31, 1999. Trinity was created in 2018, according to the commissioner's office, so it doesn't qualify.

HCSMs have been around since the 1980s, and they're sort of like religious GoFundMes. Members of a particular faith group enter into an agreement to share health care costs under certain conditions. Often they pledge not to drink, smoke, or engage in any number of worldly acts that may harm health. When they get sick, the group pays their medical costs, so long as the sick person didn't violate the agreement. Given their origins in the church, these "plans" don't cover birth control pills or abortion services. Many also impose yearly caps and long waiting periods for people with preexisting conditions.

When Congress was putting together the Affordable Care Act, they initially wanted to ban anything that looked like health insurance but that didn't include essential benefits, coverage for pre-existing conditions, etc., for fear of new companies springing up, offering junk insurance for cheaper than the ACA, and potentially gutting the whole program by depleting the risk pool. Big HSCMs, which offer plans that look like cheap insurance but that don't include essential benefits, lobbied Congress for an exemption from the ban. They ended up scoring a carve-out with certain limitations, one being that no new HCSMs could be created, and only HCSMs created before Dec. 31 1999 could continue to operate.

These HCSMs were not necessarily designed to replace health insurance, but now, in a world with sky-high premiums and no penalty for not carrying health insurance (thanks, Trump!), they're an attractive "option" for people who struggle to afford the plans on Obamacare.

Aliera is allegedly taking advantage of this situation and trying to pass themselves off as a legitimate HSCM for profit, and there's not much the state can do to prevent this kind of thing from happening in the future.

Legitimate HSCMs could lobby the state legislature and ask them to impose regulations requiring more visible disclaimers on marketing materials, but there's little incentive to do that in a growing market. In lieu of new state laws, the insurance commissioner just has to kind of play whack-a-mole and wait for people to report weird denials of coverage. A spokeswoman for the insurance commissioner said the office is investigating two other health care sharing ministries operating in Washington that appear to be engaging in similarly deceptive practices. So keep your head on a swivel, people!