Today, soaring housing costs threaten to push tens of thousands of people out of Seattle. The people facing the greatest risk are the same people who make our city run. They are nurses, bus drivers, restaurant workers, baristas, mechanics, construction workers, teachers, and more.

Communities of color, immigrants, and the LGBTQ community are especially feeling the stress of housing displacement. Seattle’s Central District, the hub of the African American community a generation ago, is today less than 20% Black, and immigrant communities are being priced out of Rainier Valley and West Seattle.

Even tech workers are feeling the pressure of a private housing market that has failed working people. With average rents in Seattle up 69% since 2010, far beyond the rate of inflation and more than double the national average, the crisis is only getting worse. Today 46% of Seattle renters are officially rent-burdened, and one-quarter of all homeowners—especially elders living on fixed incomes and struggling with rising property taxes—are also at risk of being pushed out.

Last month’s McKinsey & Company report demonstrated the scope of the crisis. The report estimates that the region needs “between $450 million and $1.1 billion each year for the next ten years” to properly address the homelessness crisis.

It has become clear that the private market has failed us and will not fill this need.

As elected representatives, we have the responsibility to put forward policy solutions that match the scale of the problem and to mobilize our communities to win them.

In a region that houses some of the most profitable companies in the world, big business must start paying their share to fund affordable housing.

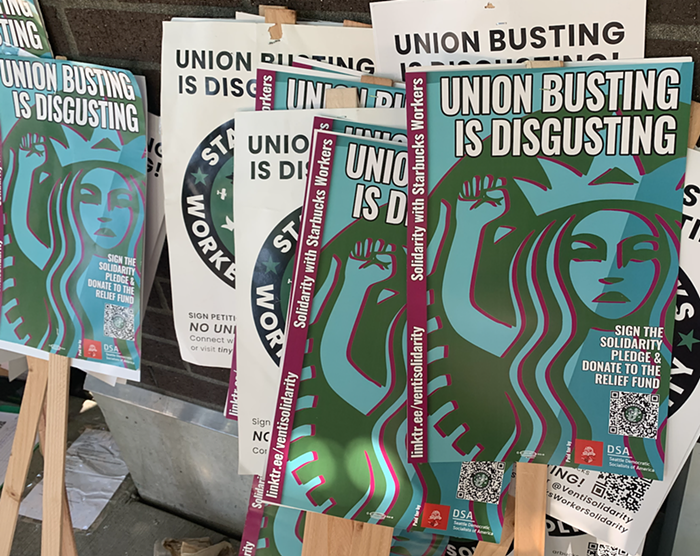

HB 2907, recently introduced in Olympia with support from major corporations, would authorize King County to implement a small payroll tax to fund affordable housing. The proposal is an acknowledgment of big businesses' obligation to pay their fair share, and it’s only happening because of the pressure that has built up over the last two years. That pressure is embodied by today’s Tax Amazon movement, which is advocating for union-constructed social housing built in-line with Green New Deal principles.

While we welcome any serious efforts to build affordable housing with progressive funding, HB 2907 would provide far too little to address the scale of the crisis. It would give King County the authority only to raise about one-tenth of what’s needed. Further, by capping the County’s taxing authority, the bill sharply limits the tools available to the County to take on the affordability crisis.

Worse yet, big business and some politicians are insisting that this legislation include a provision preempting municipalities within King County from enacting other taxes on major corporations. This would prevent voters in Seattle and other cities—now and in the future—from raising the progressive funding necessary to address the housing crisis.

Preemption would essentially transform our region into a tax shelter for Amazon and other super-wealthy corporations, all while the homelessness crisis worsens and tens of thousands of renters and homeowners continue to be driven away by soaring housing costs.

Washington already has the most regressive tax system in the nation. Working people and small businesses are overtaxed, while big business pays little to nothing. We need the ability to tax these corporations as an alternative to more regressive taxes on ordinary people and small businesses. In addition, HB 2907 fails to exclude all small businesses. We stand in solidarity with small businesses in opposing this approach.

Over the last two years, we’ve had a robust public debate around whether big business has an obligation to pay taxes so that we can build more affordable housing. Last fall, Amazon and other big businesses weighed into the Seattle elections with millions of dollars. And the voters sent back a clear message, rejecting Amazon’s candidates and electing progressives, among them the authors of this article.

We should look at every avenue to tax big business and fund affordable housing, including HB 2907. However, we are equally committed to protecting the rights of local voters to decide for themselves whether, and how much, they want to tax Amazon and other big businesses. We call on other elected officials to join us in immediately and publicly rejecting this anti-democratic, corporate tax haven preemption provision.

Lastly, we fully support the Tax Amazon movement in Seattle and its effort to fund social housing and a Green New Deal. That is the path forward that we need—not yet another tax shelter for Amazon and big business.

State Senator Joe Nguyen represents the 34th District in Washington, King County Councilmember Girmay Zahilay represents District 2, Seattle City Councilmember Kshama Sawant represents District 3, Seattle City Councilmember Tammy Morales represents District 2, and Takele Gobena is Position 5 on the SeaTac City Council