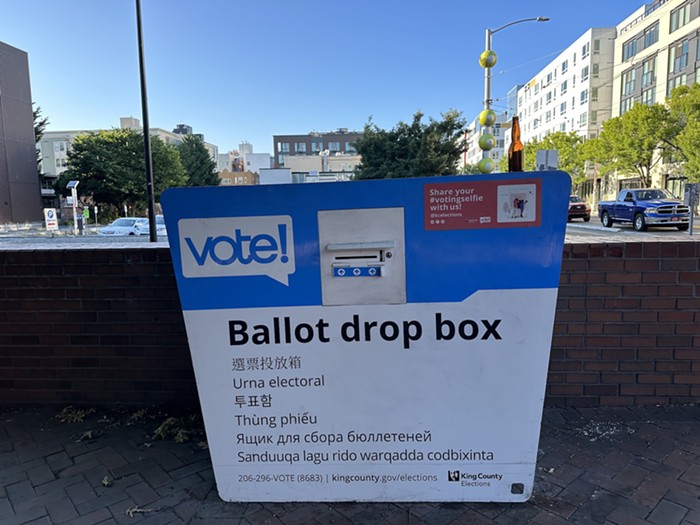

The city will be forced to make make millions of dollars in unplanned cuts if several tax-repeal measures pass on the November ballot. In a worst case scenario for the next two years, the city will face—in addition to the $67 million shortfall already on the table for next year—“$11.7 million in deficit, depending on the voters’ choices,” council staffer John McCoy writes in a brief he presented at a Seattle City Council budget hearing this morning.

The looming threat puts the council’s budget decisions in limbo—waiting for the election results—and makes city leaders particularly nervous that vital funding for human services could vanish. “It does look gruesome,” says Jean Godden, chair of the city council’s budget committee. “We still have our budget up in the air because of these initiatives.”

The most severe impact would result from the passage of both liquor initiatives, I-1100 and I-1105, which would cause a two-year deficit of $8.8 million. A repeal on candy and soda taxes from I-1107 would create another $2.9 deficit, the city estimates.

Exacerbating pressure on the city, both the state and county have withdrawn funding for human service over the past few years—particularly medications for the indigent—leaving Seattle facing “the sort end game in which the city is... the last resort,” Godden says.

Nicole Macri, director of administrative services for Downtown Emergency Service Center (DESC), left a meeting today with Godden alarmed by the figures. If the measures pass in the just the wrong way, she says, “Services will just not be available to people who need them—not just services that are good to have, but basic survival services.” Health care, mental health care, and food could all be on the chopping block.

The city directs $5 million to DESC's programs each year—helping paying for shelter beds and 380,000 meals annually. DESC receives $5 million from the city each year; of that, $1.83 comes from the city’s the general fund. And DESC is not alone, Macri says: “I have not talked to a homelessness or low income service provider who would not be impacted.”

However, if voters feel generous by passing a 0.2 percent sales tax, Prop 1, the city would receive a windfall of $20.8 million over the two years, the report says (.pdf).

Godden says wait and see. “We are trying our very best to minimize the impacts as much as possible, but we will all feel it," she says, "and I mean all.”