That's the conclusion Thomas Piketty of the Paris School of Economics has come to in his new book Capital in the Twenty-First Century. The New York Times has a sharp—and terrifying, in that deep, dull feeling of watching something you fear is true being proven—review and interview with Piketty:

What if inequality were to continue growing years or decades into the future? Say the richest 1 percent of the population amassed a quarter of the nation’s income, up from about a fifth today. What about half?

To believe Thomas Piketty of the Paris School of Economics, this future is not just possible. It is likely...

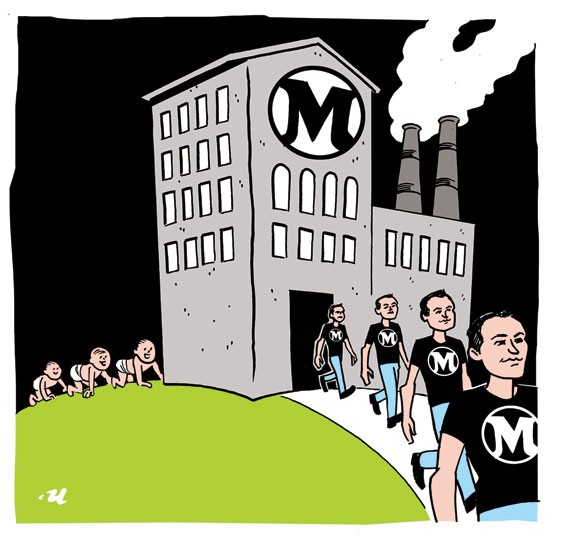

His most startling news is that the belief that inequality will eventually stabilize and subside on its own, a long-held tenet of free market capitalism, is wrong. Rather, the economic forces concentrating more and more wealth into the hands of the fortunate few are almost sure to prevail for a very long time.

It is possible to slow, or even reverse, the trend, if political leaders like President Obama, who proposed that income inequality was the “defining challenge of our time,” really push.

“Political action can make this go in the other direction,” Professor Piketty told me. But he also adds that history does not offer much hope that political action will, in fact, turn the tide: “Universal suffrage and democratic institutions have not been enough to make the system react.”

According to Piketty, the pessimism of Dickens and Marx were well-founded—the invisible hand is not your friend.

Read the whole thing. Then go read the Q&A with Piketty, excerpted below.

Q. What are the risks from allowing an ever-increasing concentration of wealth and incomes? Is there a point when inequality becomes intolerable? Does history offer any lessons in this regard?

A. U.S. inequality is now close to the levels of income concentration that prevailed in Europe around 1900-10. History suggests that this kind of inequality level is not only useless for growth, it can also lead to a capture of the political process by a tiny high-income and high-wealth elite. This directly threatens our democratic institutions and values.

Q. You noted that the concentration of wealth was stopped in the 20th century by war, hyperinflation and growth. Are there other options? What could we do now to counteract the current accumulation of wealth into very few hands?

A. The ideal solution is a progressive tax on individual net wealth. This will foster wealth mobility and keep concentration under control and under public scrutiny. Of course other institutions and policies can also play an important role: Inflation can reduce the value of public debt, reform of patent law can limit wealth concentration, etc.

Q. Owners of wealth are unlikely to like this solution. And they probably have the political power to stop it. In this sense, do you think our democratic systems will be able to address and slow this trend?

A. The experience of Europe in the early 20th century does not lead to optimism: The democratic systems did not respond peacefully to rising inequality, which was halted only by wars and violent social conflicts. But hopefully we can do better next time. At the end of the day, it is in the common interest to find peaceful solutions.