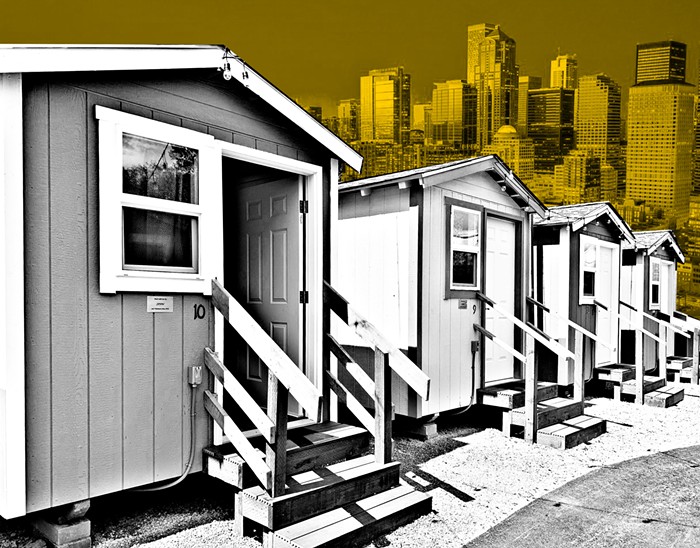

According to information gathered by Zillow, the Seattle-based online real-estate data company, and recounted in a Seattle Times post, the "typical monthly rent in the Seattle metro area surpassed $2,000" and is up an astonishing "9.7 percent in the past year." As a consequence, Seattle is number one in rent growth in the US. But what is causing this sharp increase? Seattle Times gets this answer from Zillow's chief economist, Svenja Gudell, who sounds just like someone who has received a solid education in the nonsense of neoclassical economics: supply and demand. (Gudell also mentions that the market is building a lot, but only for those with a lot of money.) There is, however, no mention of the financial sector or speculation. None. The fiction turns out to be the absence of fictitious capital.

One the last page of John Maynard Keynes' Depression-era masterpiece The General Theory of Employment, Interest, and Money, you will find this passage:

Practical men who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back...This is our economist at Zillow. In her frenzy, she has distilled the dusty Scotsman Adam Smith and his theory of prices. In this view of things, which in our age has been mathematized into the efficient-market hypothesis, what the rent increases represent is a disequilibrium that can only be corrected by the market itself. All markets, you see, tend toward a stable point between supply and demand—equilibrium. It is for this reason, many urbanists, who are also unknowingly possessed by an "academic scribbler," and so expect prices to fall when demand falls, come very close to liquidationism.

What is missing from the picture is, of course, reality, which is always defined or shaped by historical developments. What is absent from much neoclassical thinking is precisely history, and so its frame of reality tends to be empty, contentless. This is why when the housing crash of 2008 occurred, the neoclassical school of economics, which is still the dominate mode of economic thinking, called it a "black swan." It was not supposed to happen. It was not in their mathematical models. It came from nowhere. This nowhere only existed in the absence of a history that contained events like the 1998 collapse of Long-Term Capital Management, the savings and loan crisis of the 1980s, and much, much more. These instructive events were not at all dissimilar to the crash of 2008, which was caused by financial markets that are pressed, as always, to find high-grade investments with high yields and burdened by private debt.

Property is also what the British call a placement, meaning, to use the words of Joan Robinson (the greatest heterodox economist of the 20th century), a "store of purchasing power for its owner." This means, if a property market is open (or weakly regulated), its value as use becomes subordinate to its value as storage and value as exchange. And it is here the politics of absence makes its appearance. We are still talking about the housing supply in the terms of use value, when in fact the housing supply has become, democratically speaking, about useless values. To exclude finance from the economics of Seattle's red-hot real estate market is pure madness. We are in the process of making yet another one of those black swans.

Note: I forgot to link Lisa Herbold's post "Wall Street’s impact on Seattle’s housing affordability."