Well, that was fast. Less than two months after proposing a property tax for homeless services, Mayor Ed Murray is scrapping his plan to instead pursue a joint city-county sales tax to help get people off the streets. Murray made his announcement with benevolent rich guy Nick Hanauer and King County Executive Dow Constantine standing by his side.

Murray claims his new proposal will bring in more dollars. Instead of a property tax levy raising $275 million over five years—effectively doubling the amount Seattle spends on homelessness—the City of Seattle and King County's proposed .01 percent sales tax is projected to raise about $68.6 million a year starting in 2018. According to county research, that would increase to $80.9 million in 2023 and $94.1 million in 2027.

Murray didn't lay out any specifics on what the new revenue would pay for. A city and county task force (surprise!) will spend the next year figuring out what that money should fund before possibly sending the tax to the voters. Meanwhile, the city continues to reassess the contracts it has with homeless service providers, attempting to show it's spending its homeless money effectively. Murray also promised to send legislation to the city council to create an oversight panel to monitor the city’s efforts to address homelessness.

“To those who feel we cannot wait… I share your impatience to do more," Murray said today. "But I am convinced that being bolder, going bigger, and acting regionally is the only credible response to this growing crisis."

Constantine, Murray, and members of the King County Council insisted a regional approach will more effectively address homelessness than a city levy.

King County Council member Claudia Balducci, who represents Bellevue, called homelessness a “truly regional issue that needs a regional solution” and said it is apparent “even in areas known for their prosperity” like Bellevue.

Local leaders dodged the question of what exactly has changed since Murray's initial pitch. The idea that homelessness is a regional problem certainly isn't a new one. Despite some complaints about another Seattle property tax, Murray said he saw polling indicating Seattle voters would have passed the levy. Murray first revealed the plans to the Seattle Times Editorial Board. The Times recently ran an op-ed questioning the need for the levy.

"I must admit I am a little sad to not be moving forward with our city initiative," said Hanauer, who spearheaded the city levy proposal and pledged to bankroll the campaign to pass it. Hanauer said he "will be no less committed" to shaping and helping pass the county levy.

This year, the county will also ask voters to renew the Veterans and Human Services Levy, a property tax that raises about $18 million a year for housing, job training, and other programs. Constantine has not yet released a proposal for renewing that levy, but his spokesperson said he is likely to propose increasing it. Constantine said he would work to accelerate the portion of that levy that funds housing programs.

The homelessness proposal is the second sales tax Constantine has proposed in the last month. The other, aimed for the August ballot, would fund arts and science education.

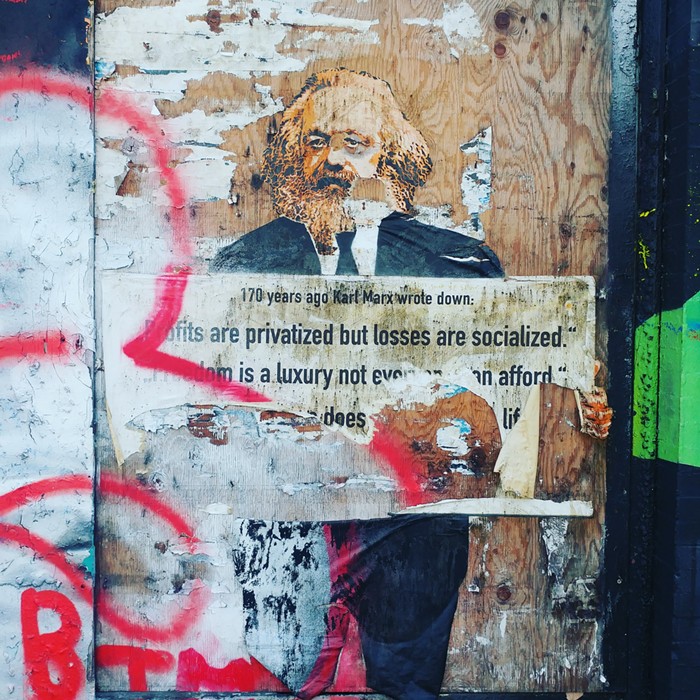

Constantine and Murray, who have both criticized Washington's regressive tax system, nevertheless defended their own use of a regressive sales tax, arguing it's one of the only options given to them by the state legislature.

"If the legislature passes other options for us to fund critical services," Constantine said, "we will gladly consider those instead."

When pressed further on the decision to use a sales tax—which is more regressive than a property tax—Murray defended the shift, saying "Washington state doesn't have progressive taxes."

That could change if the Seattle Transit Riders Union and other local organizations get their way. Although state law currently bans income taxes, those groups are pushing for a local income tax on people who earn more than $250,000 a year. If they're successful, the new tax would almost certainly face a legal challenge and end up at the Washington State Supreme Court. Supporters believe the court would be sympathetic to their cause and, if they won, the effort could make it possible to tax the rich. Murray and Constantine have been noncommittal on that proposal.

UPDATE: In an open letter Monday night, several members of the Neighborhood Action Coalition—a group of progressive activists that formed in response to Donald Trump's election and is part of the campaign for a local income tax—released an

Mayoral candidate Nikkita Oliver also criticized the move in an op-ed at the South Seattle Emerald: "This impulsive behavior, combined with the fact the mayor has taken no effective action on homelessness, leads the Peoples Party to believe the mayor has no vision for how to address this crisis."