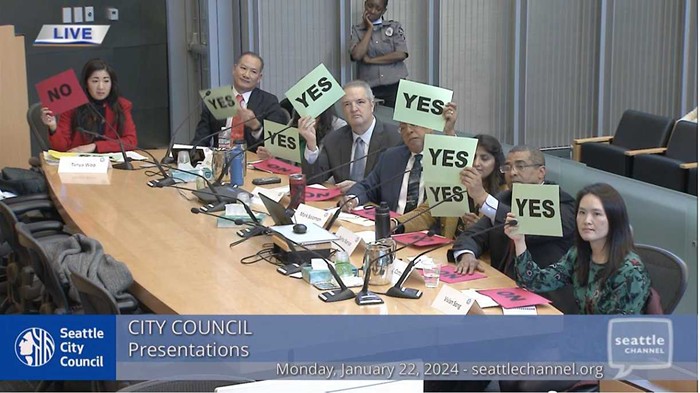

With a unanimous vote this afternoon, the Seattle City Council has OK-ed a groundbreaking new income tax.

"We will no longer tolerate a system that buries poor people in taxes," Council Member Kshama Sawant said from the dais today, a sentiment her colleagues echoed as they decried Washington's regressive tax system.

The new tax will charge 2.25 percent on income above $250,000 ($500,000 for joint filers), affecting the top 5 percent of the city's population and is designed to raise money to fund social services, reduce other types of taxes, or make up for lost federal funding. But its future is uncertain. The tax is expected to face a tough legal challenge. State law prohibits cities from taxing net income and state Supreme Court decisions have limited the ability to impose a progressive income tax.

The push for the tax began with the "Trump-Proof Seattle" coalition. That coalition—led by groups including the Transit Riders Union, the Neighborhood Action Coalition, Nicklesville, and SAFE in Seattle—pressured city council members and the mayor to support the tax. In May, Council Member Lisa Herbold sponsored a resolution laying out a timeline for considering the tax. Herbold and Sawant cosponsored today's legislation.

During a rally before today's vote, Herbold cited Seattle's support of a statewide income tax measure in 2010 and a KING 5/KUOW poll that found that 66 percent of Seattleites support a high-earners income tax.

"In the world we live in, in the city we live in, support for tax fairness is strong and it's growing," Herbold said.

During that rally, Mayor Ed Murray and several city council members also said they welcome the likely legal challenge.

"We welcome that fight because when we win that battle, just like we did on the minimum wage, it won't just be Seattle that's doing a progressive income tax," Murray said. "Make no mistake: The goal is about developing a formula for fairness and we can take it across this country but first across this state."

Seattle City Attorney Pete Holmes said he also supports the tax. "I know we have assembled an outstanding legal team to craft the best legislation possible and defend it," Holmes said.

That messaging may play into fear-mongering from Republicans who oppose the tax. Washington State Republican Party Chairman Susan Hutchison spoke to reporters after the council's vote, claiming the city's real intent is to tax all income earners, not just the rich. She also called on the wealthy to practice "civil disobedience" and refuse to pay the tax. As she spoke, she was drown out by bystanders chanting "tax the rich." Republicans are running an online petition opposing the tax and the Republican candidate in the 45th legislative district—a race that will determine the balance of power in the state senate—is promising to "protect" Washingtonians from a statewide income tax. It's worth remembering here: Democrats did not pass an income tax when they controlled the state legislature and Democratic Governor Jay Inslee has repeatedly said he does not support an income tax. Hutchison told me today she thinks Inslee can't be trusted to keep his word.

Washington has the nation's most regressive tax system. The poorest residents in our state pay nearly 17 percent of their income while those in the top 1 percent pay just 2.4 percent. In a ranking of major American cities, Seattle is among the worst for its tax burden on poor people. Public testimony ahead of the vote was overwhelmingly in favor of the tax, including comments from several self-proclaimed wealthy tech workers.

If it survives in court, the new tax will raise about $140 million a year, according to city estimates. It will cost between $10 million and $13 million to set up and cost $5 million to $6 million a year to implement, according to the city.

This post has been updated.