Rotten666's comment on Dom's earlier post is an exemplar of the hysterical and inaccurate arguments I've been hearing about I-1098 for months now:

You keep harping on our regressive tax structure, but how is this new tax going to level the playing field when it is applied to everybody else in a few years?

I don't think the word regressive means what you think it means. Regressive (when talking about taxes) means to tax those with lower resources proportionately more than those with more resources. Washington State's existing tax structure is decidedly regressive.

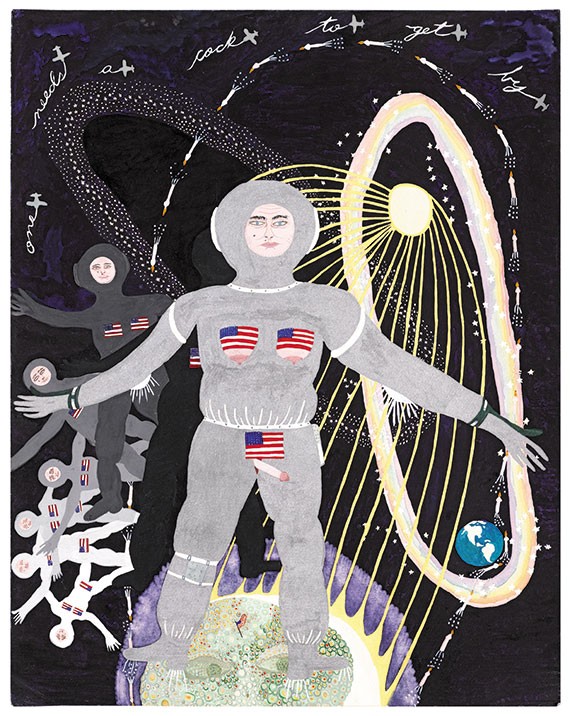

Grabbing the 2007 tax data from the Institute on Taxation and Economic Policy, we can see that poorer Washingtonians pay proportionately more in taxes than the rich. The dark grey line approximates the total tax rate:

Note how the grey line slants downward as the income increases. That's the definition of a regressive tax system: the rich pay proportionately less of their income to taxes than the poor.

What would the passage of I-1098 do to this? Let's look at the exact language of this initiative, as filed with the state [pdf]:

For Individuals:

| If taxable income is: | The tax is: |

|---|---|

| Not over $200,000 | 0 |

| Over $200,000 but not over $500,000 | 5% of the excess over $200,000 |

| Over $500,000 | $15,000 plus 9.0% of the excess over $500,000 |

The (green) line for the proposed income tax slants the opposite direction—this is a progressive tax. Look at the change in the grey line here, the estimation of the total.

If this measure passes, our tax system will less regressive overall. The more Washington finances itself with this tax as compared to sales tax, the less regressive the overall system will become.

Even if Rotten666's dire scenario plays out and the income tax is extended down to the first dollar—despite the current democratic governor indicating she'd veto any such attempt—the net result would be still a tax system less regressive than our current one:

An income tax would make Washington State's tax structure more equitable, period. Aside from the ethics of the situation—is it fair to ask the working poor to finance our lives?—there are solid economic reasons for balancing the tax load in our state. Right now, our state finances go to shit when the poor are slammed economically—precisely the time when demand on state services tends to increase. The last few years is a perfect example. If your income is from financial bonuses or stock market returns, these have been decent years. If you work for a living near or at the minimum wage, these have been terrible years. A better organized tax system is able to stabilize revenues by sharing the demands—and avoid gimmicks to balance the budget.

(I do want to give Rotten666 credit for exiting the conservative echo chamber, and commenting on Slog. Even if I do disagree with him, we must give him or her credit.)