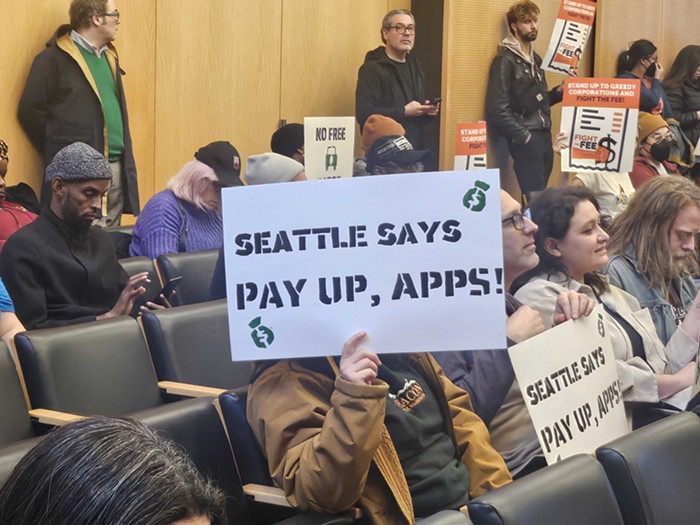

Last fall, housing and homelessness activists packed Seattle City Council chambers and demanded action on our city’s spiraling housing and homelessness crises. The movement composed of organizations and coalitions such as Housing for All, the Affordable Housing Alliance, Socialist Alternative, SHARE WHEEL, the Transit Riders Union, Real Change, and the Democratic Socialists of America brought huge pressure to bear on the city’s elected leaders.

With an overnight occupation of City Hall, in a peaceful civil disobedience action, we called for an end to the sweeps of homeless encampments, and a tax on the city’s biggest 5-10% of businesses to fund affordable housing and dramatically expanded homeless services.

A substantial tax, raising $150 million annually from big business as affordable housing activists have demanded, would be enough to build up to 750 permanently affordable, high quality homes every year, using priority hire/union local agreements to create living wage jobs. It would also set an inspiring national example, at a time when Trump is brutally attacking public services, and after his recent “tax reform” bill carried out one of the biggest acts of corporate robbery in decades.

But opposition to taxes on big business has long been “bipartisan”, and last fall local establishment Democrats rejected even a modest tax on the city’s wealthiest corporations. They voted down the proposal 5-4, with Councilmembers Bagshaw, Gonzalez, Harrell, Johnson, and Juarez voting no.

Behind the scenes, Seattle’s biggest business—headed up by the world’s wealthiest man—had begun to more heavily weigh into city politics. In the November elections, Amazon threw down $350,000 dollars behind establishment mayoral Democratic candidate Jenny Durkan. And it began to lay the ground for greater bargaining power by taking steps to set up a second headquarters outside of Seattle. The region’s politicians, including a majority of the Seattle City Council, responded by writing a public letter to Jeff Bezos, saying they “would like to hit the refresh button” if Amazon had felt “unwelcome in Seattle.”

While the establishment Councilmembers voted down our big business tax proposal last November, under the pressure of our movement they were forced to make promises, and soon created the Progressive Revenue Task Force.

Now, five months later, the task force has come back with its recommendation: for a $75 million Employee Hours Tax (EHT). This is half of the $150 million EHT that the housing movement originally put forward, but even so there is no guarantee that establishment wing on the City Council, which voted no last fall, will support it this time.

In committee on March 14, Councilmember Bagshaw said, “There is not necessarily unanimity in the community right now that we need this kind of investment.” What Seattle community opposes investing in affordable housing? Is she referring to Amazon executives, whom she and other Councilmembers met with behind closed doors last winter?

If she means small businesses, then she should set the record straight: the EHT proposal that hundreds of activists and I are fighting for would not apply to small businesses, which are already overburdened. We want to address the housing and homelessness crisis by going to where the money really is: with Amazon and the other wealthiest corporations in Seattle. Amazon scandalously received a $789 million windfall this year on old unpaid taxes just from Trump’s corporate tax cuts. In Seattle and Washington State, a greater portion of the tax burden is piled onto the shoulders of poor and working-class people than in any other state in the country.

Heavily emphasized in Bagshaw’s committee, the so called ‘skin in the game’ proposal to have small businesses pay a small amount of the tax is a Trojan horse from big business and the political establishment. Big business cannot make a compelling argument for why they should not pay taxes. If the proposed EHT is extended to cover small or medium sized businesses, it allows the largest corporations to make small business owners the face of the opposition to the tax. As many of us predicted, this has now come to fruition with 301 businesses sending an open letter to Council and the Mayor opposing the EHT altogether, citing small business concerns. (Note: the signatories to the letter were not all small businesses, and included the likes of Glen Simecek, President and CEO of the Washington Bankers Association).

Similar tactics were used during the struggle for the $15/hour minimum wage, where small and medium sized businesses were brought to the microphone to oppose $15, while big business held their meetings behind closed doors.

Winning any tax on big business will not be easy, and will require a fighting strategy. That’s why we have to recognize what “skin in the game” represents and oppose it. That is also why our movement should stick to our original demand of $150 million/year. If we win $75 million, it will also represent a huge victory for our movement, but we should not negotiate against ourselves when the battle has barely begun. Big business can easily afford the full $150 million (and more). Our priority should be to build the strongest possible movement to win the largest tax on Amazon and other big businesses.

Winning $15 in Seattle also took a fighting strategy. Some genuine progressive leaders argued at the time that our movement should collaboratively lobby councilmembers, perhaps lower the demand to $12/hour, or back a whole series of loopholes that would have excluded a large section of low-wage workers. But activists in 15 Now and Socialist Alternative put forward a bold strategy to win, including filing a ballot measure—which big business leaders later admitted was central to why they conceded on the $15 ordinance.

It was such fighting movements of ordinary people that have also won major victories in the last four years, such as the cap and payment plan for renter move-in fees, the ban on rent increases at substandard apartments, the defeat of over 400% rent increases on public affordable housing, and the defeat last month of proposed cuts to women’s homeless shelters and hygiene services.

These two strategies—establishment-friendly collaboration vs. a fighting approach based in a class struggle—have played out against each other in most serious movements, including in the recent historic teachers strike in West Virginia. The strike ultimately won major gains for teachers and other state employees at a time where unions have seen defeat after defeat. But it was able to do so only because a resolute rank-and-file union leadership won out over the negotiation and lobbying approach of higher-level leaders.

It’s not enough for local Democratic politicians to talk about resisting Trump—we need action. Raising $150 million/year (or even $75 million) from big business taxes to massively expand affordable housing can be a powerful counter to Trump’s corporate tax giveaways, and will have a profound impact on the lives of tens of thousands of people who otherwise cannot afford to live in this city.

Please join us at the Tax Amazon Town Hall Tuesday, March 27, at 6pm at Langston Hughes Performance Center. Let’s make Tuesday Tax Amazon Day.