Creating a task force to study progressive taxes is a great idea! But we don't have to wait for their recommendations to act, nor should we.

CRISTINA SPANÒ

Comments

Please wait...

Comments are closed.

Commenting on this item is available only to members of the site. You can sign in here or create an account here.

A progressive tax structure would also remove regressive taxes, eg sales taxes, and other taxes that disproportionately impact low income communities. I look forward to discussion about winding those back.

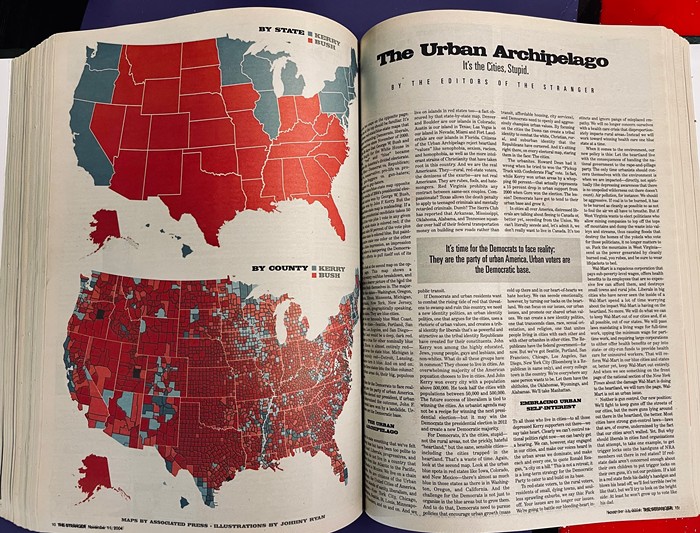

@2 there is no discussion either at the city or state level about eliminating any regressive taxes and that is the problem with all of these conversations. Ron presents a litany of ideas here but it is all based on the presumption the city needs more revenue and giving it to them will actually make a difference. Is there any evidence that is true though? To wit, the DSA published a report in Nov with these statistics:

Since 2013, taxes collected have grown by 94%, while employment grew by 19% and population by 22%.

After adjusting for inflation, per capita taxes have grown 34% over the past 10 years.

The city now collects over $600 more in taxes per person than it did in 2013, after adjusting for inflation.

Since 2013, voters have approved a series of levies and lid lifts totaling over $350M in new annual tax revenues that supplement the General Fund and in some cases supplant historic General Fund obligations.

Over the past five years, the city has adopted a series of excise taxes on business amounting to over $300M in new annual spending.

So the cities revenue was/is already growing faster than the population and employment and yet the issues facing the city only got worse. We are no better off on any of the issues that Ron raised so how is pouring more money into city coffers going to make a difference now? The assumption that government is the solution to these programs is not proven and often times government is one of the obstacles that need to be overcome.

Anyone who pays attention to this though knows that deep down the city is banking on the WA SC overturning their previous rulings and allowing for a progressive income tax. If that happens in the next few months I have no doubt the city will immediately move to implement a 5-10% tax on top of whatever the state puts forth so the rest of these ideas are really just fodder for discussion. It's unfortunate Ron and others crying out for these new revenue streams don't have the same passion when it comes to holding the beneficiaries of these taxes accountable for actually producing results.

“Expand JumpStart. It’s legal, and it’s nothing like the Trotskyist attack on business that the anti-taxxers pretended in their propaganda.”

It’s exactly a “… Trotskyist attack on business…” because it’s another “Amazon Tax,” which was Trotskyist CM Sawant’s explicit — right there in the name! — attack on a Seattle business. Blatantly lying to support your first proposal doesn’t make for a great start.

Furthermore, in our age of remote work, taxing businesses for the privilege of having workers nominally within the physical boundaries of a city is just crazy.

We can all vote no on Initiative 135. That would save the city money

here's a guy with so much money that he has the time to be on four extracurricular boards.

hey guy, can I borrow 50 dollars? city light just upped their rates 15%, per the nice postcard they sent me in the mail.

Hahaha. No.

The author has an almost Keynesian solution to the problem, but I doubt knows it....nor understand what this entails. But lets say the city moves forward to "prime the pump" of the economy with projects--Will our leaders know when to quit or will it keep on pumping until we are mired in a massive deficit?

I think not. --One only need look to the Federal deficit for instruction on this approach.

Has the author looked at the implications of higher taxes and increased expenditures and how that may affect the economy or is the author simply focused on the "short run" thrill or rush.

The city council's agenda has been openly to oppose legitimate business... in fact to drive away jobs, investment and business, to raise the rights of the few (homeless) to a higher level than that of the common man who goes to work, feeds his family, pays their bills and ever higher taxes. The City votes to not enforce the laws, defund the police, gives away millions with no consequences or accountability---none of which bodes well for anybody... workers or businesses.

If I may suggest, start with adopting policies which encourage business.

If you have a strong economy you will have more tax revenue and full employment.... and don't think that wouldn't be a welcome change to the failed and discredited polices of the past 10 years.

We actually need less, much less government involvement. It was large, grand sweeping far, far left political agendas, as well intentioned as they might have been which caused the massive issues we face today. The issue of these policies was wealth transference which lacked any real economical or well thought out methodology of achieving the desired end goal... because they enjoyed the "rush" but not the consequences of these failed and discredited methods.

Until the city councils agenda or representatives on the council have changed... Is there any reason to place place more public money into the hands of these representatives? .... I think not.