Behind an overgrown laurel hedge, a house perches over Lake Union on the north slope of Capitol Hill. Andrew (not his real name) moved in two years ago, splitting the $2,200 monthly rent with three housemates. Although the relationship between the four tenants and their landlord devolved over time, that conflict, combined with the foreclosure crisis, produced an unexpected windfall: free housing.

Rats invaded the wooden bungalow in December 2007. When their landlord failed to exterminate the pests as promised, Andrew and the other tenants stopped paying rent, certain that this would motivate the landlord to fix the problem. Instead, Andrew says, "He just dropped off face of the earth." Two months later, the tenants found a notice from U.S. Bank taped to their front door. It said the landlord was $15,000 behind on his mortgage payments and that the bank would auction the house off in April.

April came and went. "No one called us, no one said rent was late, and no one said that if we don't pay rent we will be evicted," Andrew says. The residents took care of the rodents and continued to pay utilities in their own names. But they didn't pay any rent.

Then, in early September, the bank posted another note on the door. This time, it offered the residents a deal: If they moved out within a week, they'd get $1,500 to divide among them. Knowing eviction could take months, the tenants let the week run out. They're currently in their tenth month of rent-free living. "Neither the owner nor the bank has told us we need to leave the premises at all," Andrew says. "We are renters turned squatters."

Marc Stern, a Seattle bankruptcy lawyer, says he has never heard of a similar case, but adds, "I suspect it is going to become more common."

This August, home foreclosures in King County were up 60 percent over the previous year, according to RealtyTrac, a California-based foreclosure-tracking firm. Tammy Chan, a company spokeswoman, says banks repossessed 272 properties in King County via foreclosure that month; as of August, more than 1,300 repossessed homes were sitting in inventory, unsold.

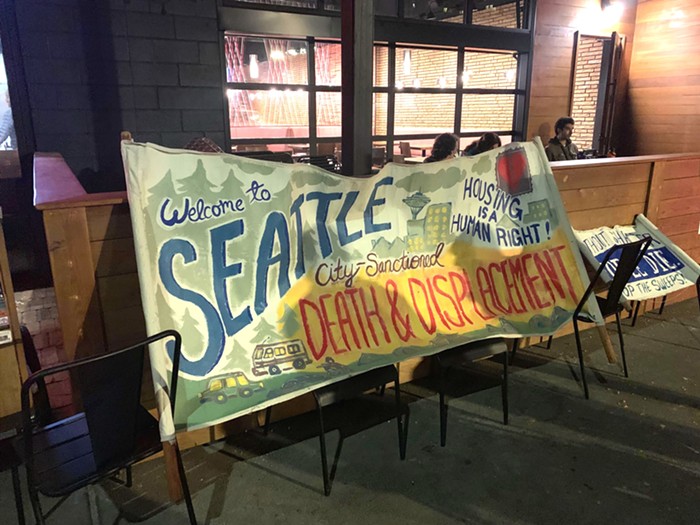

"It is very common for renters to be pushed out of their homes because of foreclosures and landlord negligence," says Emily Paddison, a community organizer for the Tenants Union of Washington State, which advocates for affordable housing and assists renters. She adds that the number of renters in foreclosed homes "has definitely jumped up a lot in the last year."

For banks, allowing tenants to remain in those houses—even tenants who don't pay rent—may make sense. "I've heard that some of them are not going to [evict residents] because it creates this liability," says bankruptcy lawyer Stern. When a bank owns a vacant house, its insurance rates go up, because there's more risk of vandalism, burglary, and fire. And some utility costs, such as garbage and electricity, continue even if a house is vacant.

Andrew and his housemates appreciate the free rent, especially because nobody has asked them to pay. Still, the uncertainty nags them. "We just live in constant fear that we will... be evicted," he says. "But we've lived in that state for so long we have become accustomed to it. We never thought it would go on so long. We thought we would be out by the end of January—and here it is October." ![]()