That was fast. Just last month, Mayor Jenny Durkan signed an employee hours tax to fund housing and homelessness services. Now, it looks like the city council will repeal the tax.

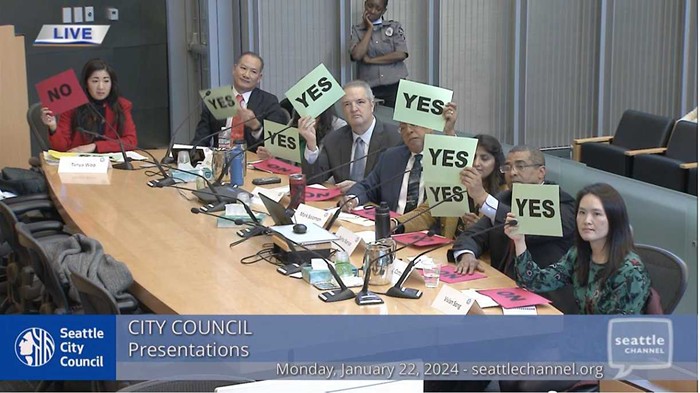

Coming up with a new revenue stream all nine council members could get on board with took months. Undoing their compromise could happen in days.

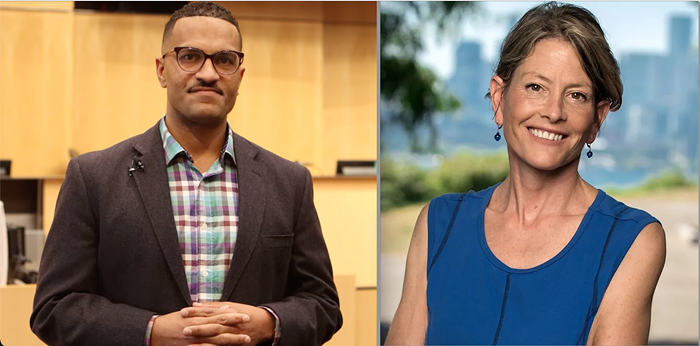

Saying he wants to press the "reset button" on one of the most divisive political debates in recent Seattle history, City Council President Bruce Harrell introduced an ordinance to repeal the tax today. Council members are expected to vote on the proposal during a special meeting tomorrow.

The employee hours tax, also known as the "head tax," collects $275 per employee from businesses grossing more than $20 million annually. It is scheduled to into effect in 2019. Should the repeal of the tax succeed, the council does not have any immediate plans to come up with new revenue for housing and homelessness services.

"There is no ordinance being drafted or a clearly articulated replacement strategy," Harrell said in a press conference. He said that the decision to introduce a repeal ordinance came after speaking with constituents opposed to the "jobs tax," as he called it, and skeptical of the city's current spending on homelessness.

"Before you impose a tax, you have to convince the public you are using the money wisely. I don’t think that persuasion has been there," Harrell said.

The council's repeal effort comes amid a business-funded petition drive to put the head tax up to voters. No Tax on Jobs, the group that is spearheading the head tax referendum campaign, last week told media it has collected more than 20,000 signatures to place the tax on the November ballot. The deadline to submit signatures is Thursday, June 14.

Businesses, including heavy hitters like Amazon and Starbucks, raised more than $350,000 to fund the No Tax on Jobs campaign.

In a statement, Mayor Jenny Durkan and seven members of the city council said, "It is clear that the ordinance will lead to a prolonged, expensive political fight over the next five months that will do nothing to tackle our urgent housing and homelessness crisis."

"We heard you," said Durkan and council members Sally Bagshaw, Bruce Harrell, Lorena Gonzalez, Lisa Herbold, Rob Johnson, Debora Juarez, and Mike O’Brien.

Council members Kshama Sawant and Teresa Mosqueda did not sign the statement.

In her own statement, Mosqueda said she "cannot back a repeal without a replacement strategy to house and shelter our neighbors experiencing homelessness."

On Twitter, Sawant called the move a "capitulation to bullying by Amazon & other big biz" and a "backroom betrayal."

URGENT ACTION ALERT on Amazon Tax to build affordable housing: @SeattleCouncil will repeal the tax on big biz at noon tomorrow! This is a capitulation to bullying by Amazon & other big biz. This backroom betrayal was planned over weekend w/o notifying movement (incl. my office).

— Kshama Sawant (@cmkshama) June 11, 2018

Harrell's announcement indicates a dramatic shift on the council, even among some of the tax’s strongest supporters. The head tax passed unanimously last month. Sponsors of the ordinance included Herbold, O’Brien, González, and Mosqueda.

An initial proposal to impose a higher tax, $500 per employee, shrunk nearly in half after it became clear that not enough council members would vote for it. Council members Bagshaw, Juarez, Harrell, and Johnson opposed the higher tax. Mayor Durkan helped negotiate the rate down to $275.

Seven of the nine council seats—all but the two citywide seats held by González and Mosqueda—will be up for reelection next year.

The Seattle Metropolitan Chamber of Commerce, one of the most vocal opponents of the head tax, welcomed the news. "The announcement from Mayor Durkan and the City Council is the breath of fresh air Seattle needs. Repealing the tax on jobs gives our region the chance to addresses homelessness in a productive, focused, and unified way," said Marilyn Strickland, the President and CEO of the Chamber.

Herbold, despite signaling that she'll vote for a repeal, rebuked the Chamber for spreading a "misleading political narrative" in an emailed statement. She said the business group successfully convinced Seattleites "of the tired, old conservative trope that increased levels of human suffering we see in our city is caused by government inefficiency rather than by the Gilded Age level income inequality in Seattle and elsewhere."

King County Executive Dow Constantine, who opposed the tax, urged regional collaboration to address homelessness. "We can only do this with the collective commitment of the entire community—business and philanthropy, labor and community organizations, government and individuals," Constantine said in a statement.

Working Washington, a labor advocacy group, said the repeal ordinance represents a capitulation to "the loudest, richest, and ugliest voices" in Seattle, referring to the referendum campaign, which has been accused of spreading false claims about the head tax.

The tax drove a wedge between unions across the city. Groups representing healthcare workers, educators, and grocery store workers supported it. Those representing construction workers were among the most vocal against it.

Reached soon after Harrell announced the upcoming vote, Monty Anderson, executive secretary of the Seattle Building and Construction Trades Council, said he hadn’t yet heard the news but supported repealing the tax.

As the city council considered the tax this year, Amazon paused planning for the construction of a 17-story tower known as “Block 18.” The Building and Construction Trades Council raised concerns that the tax would kill construction jobs at that and other projects. After the tax passed, the company resumed planning. “Amazon, Vulcan, and other developers I’ve been talking with since this happened have been thankful that at least we stood up for them,” Anderson said. “In the building trades, we don’t hate our employers… I think some of these other unions—bless their heart—took a hard line against these employers and were demonizing them.” (As we were talking, Anderson said he was receiving a call from the mayor’s office.)

Teamsters Joint Council 28, which includes various unions representing transportation workers including in the construction trades, also opposed the tax. “Mayor Durkan, along with the more sensible members of the Seattle City Council, have come to the right conclusion here,” Teamsters Joint Council 28 President Rick Hicks said in a statement.

Advocates for people experiencing homelessness denounced the move.

“We are deeply disappointed that a really conservative strategy of questioning whether or not government is using resources effectively while denying the fact that we need a dramatic increase in investments has succeeded in undoing what was the most significant commitment that this city has ever seen in taking seriously the crisis of homelessness,” said Alison Eisinger, executive director of the Seattle/King County Coalition on Homelessness, which advocates for more funding for housing and homeless services. Eisinger said she first began to hear of a potential repeal vote over the weekend.

Eisinger and other advocates have called on the city to dramatically increase its investments in affordable housing. In response, opponents of the tax have argued the city should spend its existing resources more efficiently. That ignores the scale of the need, according to advocates.

Seattle is spending more each year on homelessness services. However, multiple analyses have found the city needs thousands more units of housing affordable for people currently experiencing homelessness. That could cost hundreds of millions more dollars.

The head tax helped illustrate the scale of that need. According to the spending plan the council approved with the tax, the revenues from the head tax would have produced just 591 new units of housing. The tax revenue was also a potential source of ongoing funding for Durkan’s plan to expand homeless shelter beds. It’s not clear how that effort will be funded if the council repeals the tax.

“The only way we’re not going to be in this same place six months or 12 months or two years from now is if we have more revenue. I’m interested in hearing from every city council member, the mayor, the Chamber of Commerce, and the [Downtown Seattle Association] about any and all revenue proposals [they have]. It is a falsehood to suggest that there are solutions without cost. And the clock is ticking.”

The Transit Riders Union, which advocated for the tax, called the move “extremely disappointing.” In a statement, TRU General Secretary Katie Wilson called business group’s lobbying efforts “shameful.”

“They know very well that new resources are needed to address homelessness,” Wilson said, “and yet they have had no qualms about denying this again and again.”

Earlier this year, a countywide task force on homelessness released a list of "priority actions," but did not estimate how much those actions would cost or recommend any new revenue sources to fund them.

About 12,000 people are currently experiencing homelessness across King County, more than half of them unsheltered, according to the latest point-in-time count. The overall total is a 4 percent increase from last year; the unsheltered count is up 15 percent.

This is developing story that will be updated with new information.