Like many of you, I've spent the last few weeks working on my federal taxes, figuring out how much we owe and hoping instead that we will get a little money back. I know our taxes invest in public health to create healthy communities, fund critical infrastructure like roads and bridges, and make sure all kiddos have access to public schools. But I also know that our inequitable tax code means we don’t have enough tax revenue to meet the needs in our communities.

Washington State’s tax code relies heavily on sales tax and property tax to further fund our schools, health care system, and other foundational pillars of our state’s economy underfunded by the federal government. We may have been able to scrape by on a sales-based economy in the past when larger and more regular purchases were made in our local economies. But those days are gone. We have since shifted to a service-based economy where only a handful of services are taxed, and they are virtually all provided by blue-collar workers.

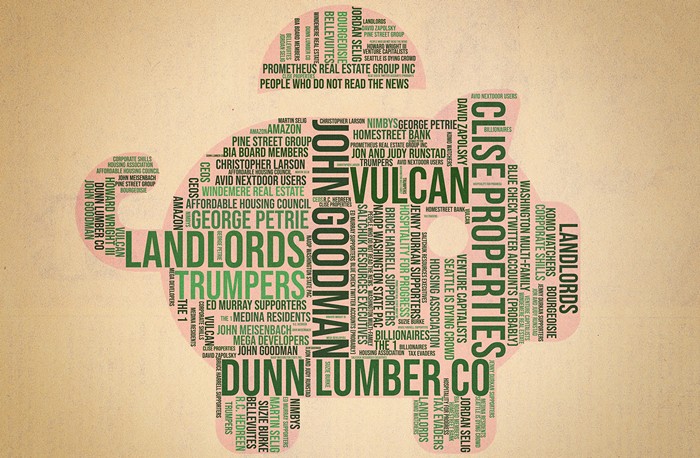

Washington State doesn’t have an income tax or capital gains tax (profits made from the sale of high-end assets) and at the city level we are left with very few options to raise the resources we need, especially in Seattle where more than 1,000 people are moving to this region every week. But we must use these revenue tools in our tool-belt at the local level to enact progressive taxes if we have any hope of meeting the growing needs in Seattle.

The lack of sufficient revenue for affordable housing is a prime example. Seattle’s affordable housing and homelessness crisis is just a microcosm of what is happening across the nation. Recent reports indicate that the median cost of a home in Seattle is now a whopping $820,000.

Currently, Seattle has the third-largest population of people experiencing homelessness in the country and housing insecurity is increasing here and throughout the state. Further compounding the revenue need is the fact that Washington public schools still don’t have the resources needed even now, public universities receive fewer and fewer public dollars, causing mountains of debt for students, and the community health system is overburdened and underfunded. Here in Seattle, without enough affordable housing and critical services like child care, many families—especially from communities of color, long-time renters, seniors, and middle-and low-income families—are being driven from the city.

Our booming economy is great, but we need more shared prosperity. The state tax revenue isn't keeping up. In fact, it continued dropping during the recession, and has stagnated through our economic recovery.

Washington State’s tax code is totally upside-down. Low income working families in our state who make $20,000 a year or less pay up to 17 percent of their income in state and local taxes. Compare that to the wealthiest, who earn $500,000 or more per year and pay less than 3 percent of their income in state and local taxes. That math makes no sense. Families and workers who are barely scraping by are paying disproportionate amounts of their income on taxes, while wealthy individuals and profitable corporations pay very little. It’s a recipe for disaster.

But here in Seattle, a conversation is underway about how to address the homelessness housing crisis through a progressive tax structure. There’s also a growing movement across Washington State to right-side-up our upside-down tax code and invest in all communities equitably. We need to all come together to address the crisis that has been created by the lack of sufficient tax revenue.

We pay our taxes this week, knowing that more folks will get health care, early learning and education, clean air and water, and basic infrastructure improvements, but we also know we must do more to fix our tax system to get the resources needed. On Saturday, April 14, I’ll be joining many of you - community, neighbors, small businesses, and education advocates—at Judkins Park for Tax Rally 2018 to demand change. Together we will fight for a more just state and local tax code and budgets that don’t come up short. The investments we make with our taxes are the cornerstones of thriving communities, they create the backbone for a healthy economy and healthy communities.

The time to act is now. I look forward to seeing you there!

Teresa Mosqueda is the Position 8 Seattle City Council member.