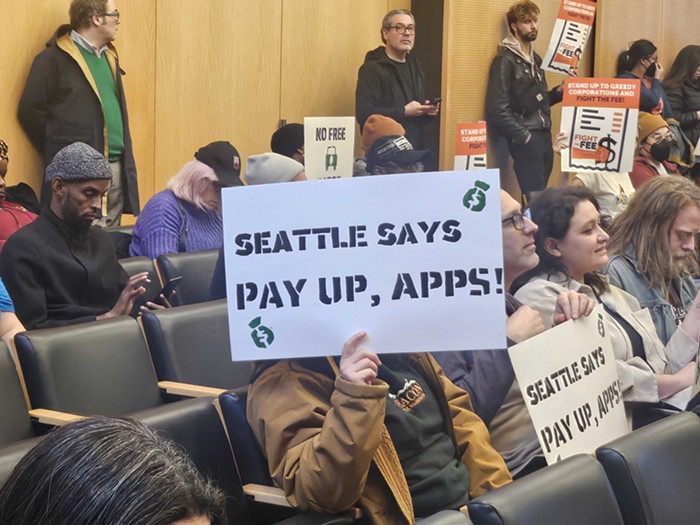

Seattle's brawl over a proposed head tax is missing some key historical context.

A major reason we're now scrapping over a Seattle head tax to fund affordable housing and homelessness services is that Washington State's tax system is badly broken, and has been for a very long time. This state has regularly been declared to have the most regressive tax system in America, and that's largely because Washington State has no income tax.

Why don't we have an income tax?

In part, it's because Jeff Bezos didn't want us to have one. Back in 2010, Bezos—along with other local tech leaders like Steve Ballmer and Paul Allen—donated big money to ensure the defeat of a statewide initiative to tax just the income of Washington's wealthiest individuals.

The defeat of the high-earners income tax forced Washington State to continue relying on its regressive sales tax, as well as the property tax, in order to fund human services and fix, under court order, our state's woefully under-funded public education system.

Is there anyone who doesn't think that more state funding for social services and education over the last eight years could have helped alleviate some of the homelessness crisis we now face in Seattle (a crisis that includes rising rates of public school students who are homeless)?

A source recently told the Seattle Times that Amazon paid $250 million in state and local taxes last year, and that's interesting, but here's a longer-view look at the public ledger:

By opposing the 2010 statewide income tax on high earners, which could have brought in $2 billion a year to fund education and social services, Amazon's CEO helped cost the State of Washington $16 billion.

By the end of this year, that $16 billion would have been spent on programs that effectively work to prevent Washingtonians from becoming homeless in the first place.*

In addition, by opposing an income tax Bezos helped to diminish the number of options the Seattle mayor and city council have for increasing local funding to combat homelessness.

Raising Seattle property taxes further isn't a good option, since doing so contributes to displacement and we're already facing a big, state-mandated property tax hike to pay for public education (because we don't have an income tax to help pay for public education).

And yet when the city council unanimously passed a Seattle income tax on high earners last year, critics insinuated a direct connection between the council's move and Amazon's decision, a couple months later, to start its HQ2 search process.

Seattle's local high-earners income tax, which would have brought Seattle about $140 million a year, is now tied up in a court fight over its constitutionality. But it's worth noting two things. One, that $140 million a year in local income tax money would have more than covered the $75 million annually for housing and homelessness that's being sought through the head tax. Two, the vast majority of places on the finalist list for Amazon's HQ2 have an income tax—so clearly the company's not that opposed to the idea.

As civic leaders scurry to figure out a way forward amid the heated head-tax debate, it would be useful to make clear why we've been left to look to things like a head tax for revenue.

In large part, it's because we don't have an income tax. (Don't want to take my word for it? Listen to this University of Washington professor make the same point on KUOW.)

So here's an idea: If Jeff Bezos doesn't like the idea of a Seattle head tax, perhaps he should commit to publicly reversing his position on Seattle and Washington State income taxes.

Mayor Jenny Durkan is currently saying that if there's going to be a head tax it needs to have an end-date. A slightly different approach from Mayor Durkan could be to say to Bezos: "The head tax ends when an Amazon-supported income tax begins."

* Even if the 2010 high-earners income tax had passed but become tied up in court for, say, three years before being upheld, then Washington State still would be about $10 billion ahead by now.