We know King County needs to spend $400 million a year to address the region's housing and homelessness crises. And we know, based on the Point-In-Time count released Friday, that increasing funding for programs that meet the specific needs of different homeless populations leads to a drop in the overall number of people sleeping on the street. But hitting $400 million requires us to raise current spending, according to McKinsey consultants, by about $200 million.

Last year's head tax was one way to raise part of that revenue, but big business revolted and the tax failed. However, the Progressive Revenue Task Force that resurfaced the head tax also proposed other progressive-ish ways to raise money. At recent forums for District 3 candidates, Seattle School Board member Zachary DeWolf has called for more conversation about the taxes listed in the report. So I asked him and the other D3 candidates whether or not they'd actually back those taxes. Some of the candidates are much more sure than the others on this question.

The Taxes

The report suggests a number of revenue generators, but I asked the candidates about the following.

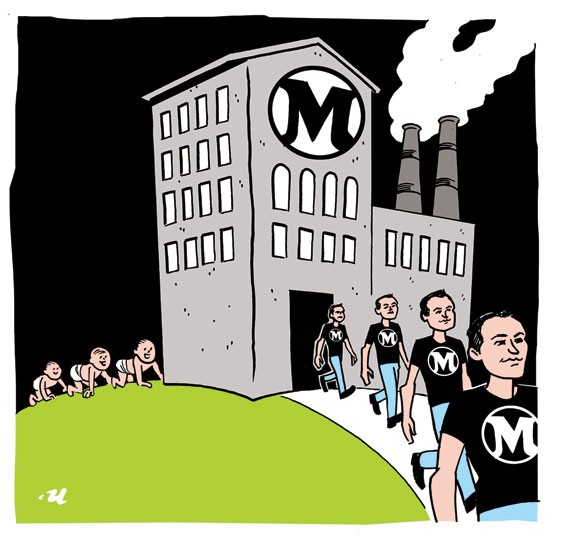

• Excess compensation tax: This is a tax on companies for paying employees over a certain amount. A sample proposal might be: Companies that compensate employees over $500,000 would be taxed at 5% per employee. Sen. Joe Nguyen introduced a similar proposal late last session, but it didn't go anywhere.

• Local progressive estate tax: This measure would levy a local progressive tax on the assets people hoarded in life. This would add to the state's estate tax, and the city could raise the rates on the wealthiest estates.

• Speculation tax or vacancy tax: These options would basically impose taxes on companies or investors who buy houses/condos/apartments but who don't live in them. Caveat: When raised as possible options during the mayoral race in 2017, City Attorney Pete Holmes declared both illegal.

• Mansion tax: This would be a local progressive Real Estate Excise Tax (REET). For example, if you sell a piece of property worth $1 million or more, the city could take an extra 0.25% excise tax on top of whatever the state’s REET would be.

The Responses

Over a drink at Oddfellows, DeWolf told me "everything should be on the table" in terms of taxation.

He also "hopes" the future Seattle-King County central authority recommends a payroll tax with exemptions for low-income workers, wherein employees would pay 1% and employers would kick in another 1%. "We know that increasing payroll tax by 1% can roughly get us $100 million," he said, so having the employer make up the difference would get the region up to the $400 million budget it needs.

DeWolf said "the system needs to tighten up," too. He would advocate for the newly formed regional authority to take money from outreach programs and put it directly into homelessness diversion programs. "Investing in diversion—that's a hill I'll die on," he said.

As for other ways to spend the money, he also advocated for a "shallow rent subsidy" program akin to the DC Flex program in Washington, D.C. In his capacity as a program manager with All Home, he has proposed a smaller rent subsidy directed at formerly homeless, low-income families of color who are currently exited to permanent housing.

Over text the next day he emphasized his desire to "listen to what the community and experts and task forces are recommending," stressing that he would be interested in these taxes as part of a "package of tax proposals to consider," adding that "bringing more resources to the homelessness crisis and our affordable housing shortage" would require "lots of community education and coordination with our county and suburban cities."

DeWolf's tack, basically, is to lead a bunch of community conversations about whether the city should try to pass these progressive taxes.

Incumbent City Councilmember Kshama Sawant answers the question a little more directly. "My office supports all such options to tax big business and the rich, instead of working families, to fund social housing and social services to address the affordability and homelessness emergency," she wrote in an email. She would not, however, support a speculation tax structured as a "foreign buyers' tax," as it was during the mayoral race. "All wealthy speculators should be taxed, regardless of national origin," she said.

Sawant emphasized, as she has in the past, that only "a determined movement of working people" will be able to win these reforms in the face of what would surely be aggressive corporate pushback.

"Unfortunately, many candidates running in this year’s city elections pretend that progressive revenues can be created by 'bringing big business to the table' and 'listening to all sides,'" Sawant added. "This is either naive or disingenuous."

Blaming Seattle's regressive tax system on "decades of domination by corporate lobbyists and politicians in both Seattle and Olympia," she said only "a real fight" will be able to win these taxes.

Capitol Hill Chamber of Commerce director Egan Orion won't say which specific taxes he supports "at this time," but says "progressive outcomes need to be first on the list," whatever that means. He proposes "a complete review of our current methods, programs, and services" before talking about increasing revenues. He also wants to work with a regional authority "to bond a half a billion dollars to build 1,500 new supportive housing units with wraparound services."

Hashtag Cannabis co-owner and scooter enthusiast Logan Bowers thinks "all of the proposals suggested by the progressive revenue task force are worth seriously considering," but he doesn't think they are "the long term funding solutions we need." Those solutions will come, he argues, from working with neighboring cities and King County, and, of course, from upzoning the city to allow for "duplexes, triplexes, and small multifamily apartments" everywhere. "This is a policy change and will cost the city nothing but go a long way in addressing the root of homelessness," he wrote.

King County public defender Ami Nguyen thinks “the county needs to increase revenue to $400 million to adequately address the regional homelessness crisis," and she supports all of the four taxes I pitched from the task force's report.

Neighborhood activist Pat Murakami said yes to the excess compensation tax “if allowed by the State Constitution” and yes to speculation and vacancy taxes. “We should have enacted both of these taxes years ago," she said. She’s not into a mansion tax or a local progressive estate tax with higher rates.