Over the weekend the Senate unanimously passed a proposal that allows Washington's largest companies to dodge upwards of $90 million in potential insurance premium taxes that would boost the state's general fund every two years.

At a moment when the state faces several crises it can't pay for, the proposal, sponsored by Sen. Mark Mullet, would drastically reduce taxes the state's largest corporations should be paying and empower only those companies to determine how much they'll pay in the first place. Instead of bringing in $90 million, Mullet's bill would only raise $677,000 in premium taxes every two years, plus a little over $1.4 million in registration and renewal fees per year, according to estimates from the Office of the Insurance Commissioner and the Office of Financial Management.

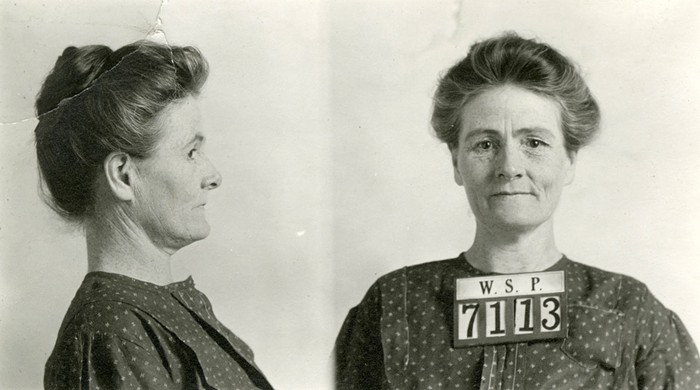

Over the phone, Washington State Insurance Commissioner Mike Kreidler stressed that these estimates were "wild-eyed" guesses, mostly because his agency doesn't know much about how entities called "captive insurers" are working in the state, as regulators only discovered companies using them here three years ago.

"The aggravating part is that no one really knows how much of a tax break we're handing out to the industry, but the industry knows they want to come in and give us a few million dollars," said Insurance Commissioner Mike Kreidler over the phone. "And any time industry says they’ll come in and write a check voluntarily, grab your wallet."

Now, to understand anything I just said, you're going to want to know what "captive insurance" is.

When big corporations want to cover some kind of risk they believe they can't get from regular insurance companies, they set up in-house insurance companies called "captive" insurers.

When Microsoft wanted to insure its cloud service, for instance, they couldn't find anyone offering cloud service insurance, so they set up their own. Alaska Airlines and others buy "terrorism risk" insurance they say they can't get through a regular insurer.

The big corporations pay multimillion-dollar premiums to these captive insurers just as they would to any other insurance company, and the captives pay out benefits to their parent companies. Those premium payments are tax deductible, making this whole enterprise extremely lucrative for large companies. They're also lucrative in another way. The alternative to using a captive insurance company to cover "terrorism risk" or whatever is simply to set up a large "oh-shit" savings account, which could be subject to federal and state taxes. Having these captives allows companies to avoid paying those taxes.

In Washington, all insurance companies pay a 2% tax on premiums, and that tax goes straight to the general fund to balance the state's books. But these captives do not and have never paid that tax. That's because, as I mentioned earlier, the Office of the Insurance Commissioner (OIC) didn't even know Washington companies were using captives until three years ago, when, Kreidler said, a staffer randomly discovered a few very large companies doing it. The agency now suspects that over 2,300 companies are using these in-house insurers.

Kreidler worries these captives create an uneven playing field in the private insurance market. While large companies can set up captives to reduce costs, small businesses are forced to insure risk on the regular market.

Since captives are illegal in Washington, the OIC started issuing cease-and-desist letters to companies such as Starbucks and Alaska Airlines to enforce the law. Because those companies really like using in-house insurers, they asked the OIC to establish a legal framework to allow them to exist. That way they could continue to use them and—more to the point—continue to enjoy the "considerable federal tax breaks" they can exploit for doing so, as Lonnie Johns-Brown explained during testimony last month.

So the OIC did just that. They wrote up SB 6241, which establishes that legal framework. The proposal imposes a 2% tax on companies who purchase insurance from captives or other "unauthorized" insurers, which aligns with federal law and treats them like any other insurance company. That proposal would bring in $90 million every two years, according to a "conservative" estimate from the OIC.

You won't be surprised to learn that the very large businesses did not want to pay this tax, and so they lobbied Sen. Mullet to propose SB 6331. This bill, which unanimously passed the Senate last weekend, requires captives to register in Washington and pay a 2% premium tax only on risk those in-house insurers cover in Washington state.

How much risk do those captives cover in Washington state? That's a good question you won't get a good answer to if this bill ultimately passes the legislature, as it only allows the companies themselves—not the regulators—to tell the regulators how much risk they're covering. And, as I mentioned earlier, rather than bringing in tens of millions of dollars, the proposal would likely only generate a few million per year. "Maybe 5% of the risk these captives insure for these big businesses is in Washington," Kreidler said.

During testimony on this bill, lobbyists for the big corporations say they'll just shutter their captives if they don't get their way. But they'd likely only do that if they ended up paying more in premium taxes than they'd pay in federal and state taxes for just keeping their money on their books.

In committee, Sen. Mullet essentially argues that a little guaranteed money is better than potentially much, much more, and so he's doing what Mullet does and pushing for the business-friendly bill.

“The Insurance Commissioner is way off on his tax calculations," Mullet said in an e-mail, adding that "none of the 29 states that regulate captive insurers treat them like he has requested."

Pointing to one of several competing fiscal notes on the bill, Mullet said "nonpartisan Senate staff believe my proposal will bring in roughly $40 million over the next three years.”

Either way, since the bill passed the Senate, it's now up to the House to decide if they're comfortable giving the state's largest businesses a multimillion-dollar tax break and barring regulators from doing their job.