The day after the Seattle City Council repealed a tax that would have funded low-income housing, a new report highlights the ongoing lack of affordable housing for the nation's lowest income renters.

Despite state and city minimum wage increases, nowhere in the United States can a full-time minimum wage worker afford a two-bedroom apartment, according to a new report from the National Low Income Housing Coalition.

Each year, the group's "Out of Reach" report calculates the gap between the costs of rent and how much renters make. The report uses the minimum wage, mean renter wage, and the Department of Housing and Urban Development's definition of fair market rent. To define "affordability," it uses the industry standard of spending no more than 30 percent of income on rent. Increasingly, households across the country spend 50 percent or more of their income on housing, making them "severely cost-burdened."

Here in Washington, workers need to make $19* an hour to afford a studio apartment, $22 for a one-bedroom, $27 for a two-bedroom, and $39 for a three-bedroom. In the Seattle-Bellevue metro area and King County, the numbers are higher: $26 an hour for a studio, $29 for a one-bedroom, $36 for a two-bedroom, and $52 for a three-bedroom.

In contrast, the state minimum wage is currently $11.50 per hour. That will increase to $13.50 by 2020. In Seattle, the minimum wage currently ranges from $11.50 to $15 an hour depending on the size of the employer and benefits offered.

Calculated another way, those housing costs mean a worker making Washington's current minimum wage would need to work 75 hours a week to afford a one-bedroom apartment. For someone in need of a two-bedroom, like a single parent with a child, that jumps up to 93 hours per week. Compared to other states, Washington ranks as the eighth most expensive state for a two-bedroom apartment. (Hawaii is first, California is second.)

The report also looks at the mean wage for renters, since many people make more than the minimum wage. Still, the results are bleak.

The mean Washington renter makes $19 an hour, according to the report. In Seattle/Bellevue, it's $24 and across King County it's $25. Even at those wages, it would take 57 hours a week to afford the statewide rent for a two-bedroom apartment. In Seattle, a worker making the mean wage would have to put in 49 hours for a one-bedroom and 60 hours for a two-bedroom.

The report recommends federal investments in programs like public housing, vouchers, and rental assistance.

In a preface to the report, Senator Bernie Sanders writes that "wages have been stagnant for decades, while the cost of housing keeps going up."

"In America today, nearly 11 million families pay more than half of their limited incomes toward rent and utilities," Sanders writes. "That leaves precious little for other essentials, like food, transportation and health care—much less a few extra dollars to take your kid to see a movie."

And that trend looks unlikely to reverse any time soon.

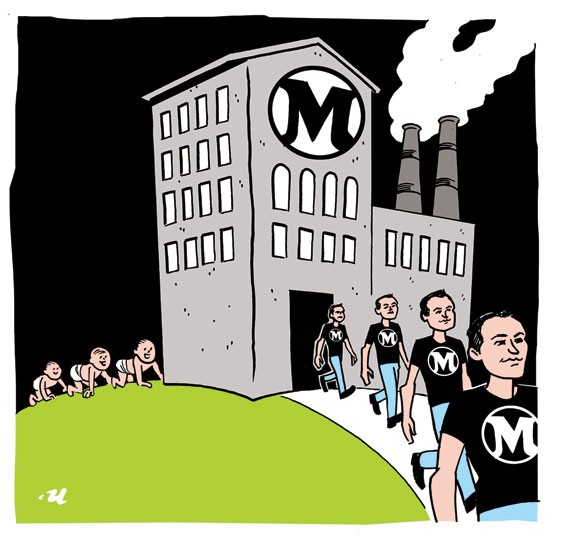

"Low-wage work is expected to grow," the report reads. Seven of the ten jobs expected to grow the most over the next decade pay less than the amount needed to afford a one-bedroom or two-bedroom apartment, according to the report. Among those jobs: personal care aides and food preparation jobs. The three jobs expected to both grow and pay enough to live—general operations managers, software developers, and registered nurses—"require advanced degrees or significant experience."

Meanwhile, the housing market is failing to meet the needs of the lowest income renters. Citing 2017 Harvard statistics, the report highlights the type of housing being built:

According to the Joint Center for Housing Studies (2017), the number of homes renting for $2,000 or more per month increased by 97% between 2005 and 2015 with the new development of high-end apartments and rising rents of existing apartments. During the same time, the number of homes renting for less than $800 declined by 2%.

The report also questions "filtering," the idea that if developers just keep building enough market-rate housing, that housing will eventually become affordable for low-income people.

Most low income renters rely on older units that become affordable over time as newer units are developed. But this process, known as filtering, does not produce enough affordable rental homes to serve extremely low income renters. When rents reach a level that the majority of extremely low income renters could afford, landlords in strong housing markets have an economic incentive to redevelop their units for higher rents. Landlords in weak housing markets often find the cost of upkeep is higher than the rent they are able to collect, and they therefore decide to abandon maintenance on the housing or repurpose the property.

The takeaway?

"Absent public subsidy," the report reads, "the private market fails to provide sufficient housing affordable to the lowest income households."

*I've rounded the wage figures from the report to the nearest dollar. Predictably, the statewide figures are lower if you only look at non-metro areas. You can download more Washington data here. To read the full report click here.