In a press conference Tuesday, House Our Neighbors! (HON) launched a citywide ballot initiative to create a new progressive tax to permanently fund the social housing Public Development Authority that voters approved in a February 2023 ballot measure.

If HON can collect at least 26,520 signatures within 180 days, then voters will decide whether or not to tax big business for more housing this November. With turnout at its highest due to the presidential race on the ballot, the success of their initiative, particularly next to initiatives that repeal taxes on the ultra-wealthy at the state level, could put to rest the debate about voter sentiment on progressive taxation verses austerity budgeting, the City’s most pressing, existential question in the face of a quarter-billion-dollar shortfall next year.

JumpStart’s Hot Younger Sister

In the 2024 City budget, the City of Seattle failed to establish a permanent, ongoing funding source for the PDA, contributing only the legally required start-up costs. Seeing that the previous council couldn’t muster the political will to find the money for social housing, HON Policy & Advocacy Director Tiffani McCoy said her organization didn’t want to waste the time lobbying the new, more conservative council.

Motivated to see its project through, HON will put the question to voters with an initiative that imposes a 5% payroll tax on businesses that pay employees more than $1 million per year. The tax would start collecting in 2025, and HON estimates it would raise $52 million per year. That money would pay for an estimated 1,700 to 2,500 newly built and acquired social housing units, ranging from studio to three-bedroom, for tenants making between 0-120% of the area median income (AMI), with rent priced at 30% of their income. HON's estimates do not include any bonding or state or federal funds, which would pay for even more units.

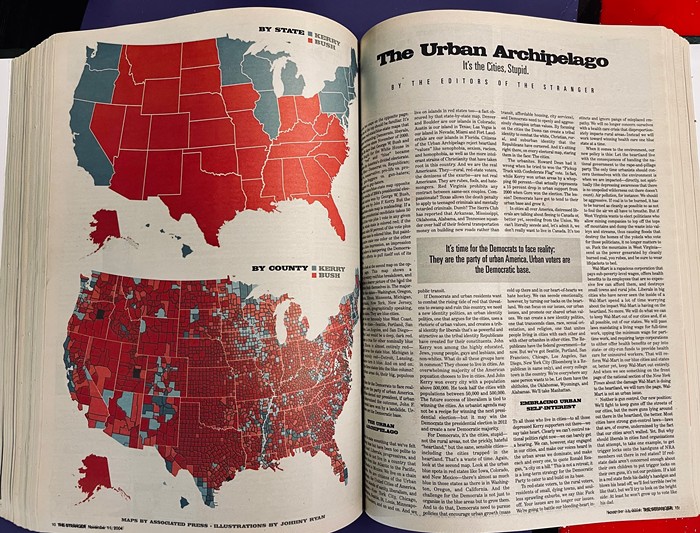

Does a payroll tax sound familiar? If so, that’s probably because in 2020 the Seattle City Council passed “JumpStart,” a payroll expense tax that charges the very largest businesses–those that spend at least $7 million on payroll–between 0.7% and 2.4% on salaries of employees who make more than $150,000 per year. HON’s Social Housing payroll tax would not take any revenue from JumpStart, making good on the campaign’s initial promise not to take from existing funds for affordable housing.

While both JumpStart and this social housing payroll tax would hit some big businesses (sorry, Amazon), McCoy said that HON’s tax would touch some sectors that JumpStart does not. For example, JumpStart exempts grocery stores, and HON’s tax would not. HON’s tax, McCoy said, would also draw revenue from wealth management and real estate companies that may not be large enough to pay into JumpStart but that still pay incredibly high salaries.

Though HON’s proposal builds off the scaffolding of the court-tested JumpStart, which may offer some peace of mind to politically anxious observers worried about the tax standing up to legal challenges, opponents will likely subject it to perpetual political attacks anyway, just as they do with JumpStart.

Since its inception, Mayors have tried to raid JumpStart funds–which the Council earmarked specifically for affordable housing, green new deal projects, and economic development–to pay for their own priorities. And now it would seem as if big business wants to direct their newly bought city council to permanently funnel JumpStart dollars into the general fund, defunding those important programs to fill the huge budget hole.

Luckily for HON, under City law, their tax would be safe from any of that kind of fuckery for two years after its passage. Whew.

The State of Play

But before I get too ahead of myself, McCoy anticipates a strong, well-funded opposition campaign to this measure. HON raised more than $300,000 for its last campaign, but their enemies have richer, eviler donors who could bury them. After all, big business and real estate just poured more than $1 million into buying a council that would oppose taxation.

Many of those new electeds told Real Change News they support funding the PDA. Council Members Tanya Woo, Tammy Morales, Joy Hollingsworth, Maritza Rivera (kinda), and Cathy Moore all said “yes,” the City should pay more into the PDA. Council Members Rob Saka and Dan Strauss said “maybe,” and Council Member Bob Kettle did not attend the interview.

Still, duty-bound to their anti-tax donors, some council members could misuse HON’s campaign as an excuse not to pass other new progressive revenue to fill the budget hole. To be clear, the council would be hugely misguided in doing that, since HON’s money funds the PDA specifically. But with Council President Sara Nelson at the wheel, fuckery should be expected.

Plus, right-wing multi-millionaire Brian Heywood put state-level progressive revenue on the chopping block this election with an initiative to repeal the capital gains tax. His villainy scared the previous city council out of passing new progressive revenue last year, and it’s also helping to stop the Democrats in the State Legislature from doing much of anything this session.

Even with all those external factors in mind, McCoy said she’s not nervous about it. She knows her team can pull off a winning ground game. She knows Seattle supports social housing. And she knows the housing crisis won’t wait for Heywood or big business to have a sudden change of heart.

“We can’t wait for a more opportune time to pass this,” McCoy said.